Table of Contents What is CLV? Why it's important How CLV Impacts Decision Making CLV Growth Engine Customer Lifetime Value (CLV) is one of the most …

Listen to this article

Cleverbridge and Adyen partner to power the next generation of global commerce. Read the announcement

Table of Contents What is CLV? Why it's important How CLV Impacts Decision Making CLV Growth Engine Customer Lifetime Value (CLV) is one of the most …

Written by

Share this post

Subscribe for best practices on optimizing your software business.

Listen to this article

Customer Lifetime Value (CLV) is one of the most important KPIs for eCommerce and SaaS platforms. eCommerce CLV in SaaS is a leading indicator that can help determine marketing allocations and performance, forecast future revenue, and build sustainable growth plans.

By monitoring CLV and analyzing customer data, you can deploy targeted customer retention strategies to drive renewals, cross-sells, upsells and reduce customer churn.

In this article, we’ll discuss what is CLV and how to calculate CLV, its importance, and actionable strategies for improving revenue.

/The%20Importance%20of%20Marketing%20Tools%20For%20Digital%20Products%20%26%20SaaS%20Companies-01.png?width=422&height=328&name=The%20Importance%20of%20Marketing%20Tools%20For%20Digital%20Products%20%26%20SaaS%20Companies-01.png)

Customer Lifetime Value measures how much revenue you can expect to generate over the lifetime of the customer relationship. Understanding CLV helps you project future revenue and set reasonable benchmarks for customer acquisition costs (CACs).

This is crucial for eCommerce businesses to manage cash flow and build sustainable growth.

If an average customer subscribes to your SaaS business for a year, their lifetime value will be the total revenue you can generate within that year.

Obviously, the longer you can keep a customer, the more revenue you can generate.

It’s much more expensive to acquire new customers than keep existing customers, so focusing on customer retention and renewals is key to extending the average customer lifespan and optimizing revenue potential. Repeat customers tend to spend more at a higher purchase frequency.

CLV = Average Order Value x Average Purchase Frequency x Average Customer Lifespan

To calculate the CLV, you need to know and understand several key metrics:

To determine the average purchase value (AOV), you calculate the total revenue earned during a specific period and divide it by the total number of sales generated.

Average Order Value = Total Revenue/Total Number of Purchases

For example, if your eCommerce store generated $200,000 a year from 2,000 purchases, then the AOV would be $200,000 / $2,000 = $100.

Average Purchase Frequency (APF) is calculated by dividing the number of purchases made by unique individual customers during the same period.

Average Purchase Frequency = Number of Purchases / Number of Unique Customers

So, if 400 customers generated the 2,000 purchases, the APF would be 2,000 / 400 customers = 5.

The Average Customer Lifespan (ACL) is calculated by adding the total lifespan of your customers and dividing it by the total number of customers you have.

Average Customer Lifespan = Total of Customer Lifespans / Number of Customers

It can be difficult to estimate the average customer lifespan, especially for newer companies, because they lack the historical data to estimate customer lifespans.

Most companies use this metric instead: 1 / Churn rate

Take the number of customers you have at the start of the period and the number of customers you have at the end of the period. For example, if you had 500 customers at the start of a month and lost 50 customers at the end of the month, your churn rate is 50 / 500 = 0.1. The ACL would be 1 / 0.1 = 10 months.

Using our example above, we can now put it all together to determine CLV:

CLV = APV X APF X ACL

CLV = $100 x 5 x 10 = $5,00

To maintain a sustainable growth trajectory and grow a stable flow of recurring revenue, SaaS businesses must understand and focus on growing customer lifetime value.

This can be done by focusing on creating outstanding customer experiences and generating value for your customer - doing so will increase customer loyalty and ultimately grow your CLV.

SaaS businesses must continue to evolve and reinstate their value to customers; across all stages of the customer lifetime value. By not doing so, you risk losing customers to competitors.

Why is CLV so important for SaaS businesses?

The larger your CLV from your customer base, the more each customer spends with your company. The longer you can keep them as customers, the more revenue you can generate.

Studies have shown just how important customer retention is. Loyal customers spend more frequently and spend more when they make purchases. Returning customers spend, on average, two-thirds more than new customers.

Yet, it costs five times less to successfully generate sales from an existing customer than from a new one.

When you consistently provide an enhanced customer experience and supplement it with loyalty programs, renewal automation, and nurture customers over the lifecycle, you can grow revenue significantly and improve the CLV.

/CLV%20Growth.png?width=254&height=255&name=CLV%20Growth.png)

When you know and track your CLV, it provides you with the data you need to make informed decisions.

For example:

Deploying a robust customer retention platform can help reduce churn and grow CLV. The data you get from your efforts can also help you segment and identify your best and highest-value customers.

When you understand how these customers came to your product or service, how they engaged with your platform and marketing, and why they remain loyal customers, this information can help you apply similar strategies to grow your customer bases and increase their loyalty.

This data is invaluable in targeting potential customers and reducing churn.

Using an integrated customer database across sales channels and deploying a robust customer success platform to orchestrate and automate subscriptions and payments are key to maximizing customer lifetime value.

For example, an integrated customer success platform can help you analyze:

To be effective, these data points must be continuously updated and monitored. SaaS companies must also deploy different models to maximize ROI for CLV.

For example, analysis of historical data from customers can help establish CLV benchmarks and identify behavioral characteristics of customer groups.

This can help inform marketing and customer retention strategies. Predictive models using artificial intelligence (AI) and machine learning (ML) can use these patterns to predict churn based on warning signs. The best customer success platform can then automate outreach to address these warning signs and improve retention.

This data can also help you identify key attributes that indicate the potential to improve CLV and attract new customers. For example, you can identify which customers are most likely to:

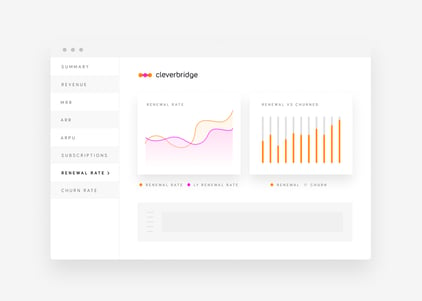

The Cleverbridge CLV engine drives customer loyalty and helps improve Customer Lifetime Value by providing an end-to-end eCommerce solution to process transactions and automate renewals without human intervention.

Automation handles low-level, repetitive admin tasks and retention marketing. This allows your sales team to focus on high-margin and high-value customers while minimizing the time and effort it takes to renew other customers.

You also get the data and insights you need to analyze and understand your customer health. For example, you get transparency into the probability of churn for customers based on their behavior and warning signs. This allows you to target individual customers with personalized strategies for retention.

You can nurture customers throughout the lifecycle and manage the entire sales funnel. For example, Cleverbridge lets you set up products and bundles, use fixed or variable pricing, launch free promotional periods, add discounts, and personalize customer offers.

You can also leverage the Cleverbridge platform by using renewal automation cadences for B2B clients, such as:

Cleverbridge also makes it easy for customers to upgrade or downgrade, activate auto-renewals, add new services, can convert from trial subscriptions to paid subscriptions. Clients using Cleverbridge solutions see an average churn rate reduction of 10%.

You can also deploy strategies to improve retention, such as timed renewal discounts for lagging customers, A/B testing to optimize offers, and nurturing customers during their subscription periods to educate and reinforce value.

Improving your customer retention and reducing churn is crucial to success. You can learn more by downloading our guide, 11 Proven Strategies to Reduce Your eCommerce Churn Rate.

You can also improve the CLV by driving cross-sells and upsells. Cleverbridge lets you create custom offers based on customer attributes to maximize revenue from your existing customer base.

Data-driven organizations are 23 times better at acquiring customers and six times more likely to retain customers, according to McKinsey research. Cleverbridge can help you collect, analyze, and leverage customer data, then automate customer retention strategies to improve performance.

Learn more about how Cleverbridge can grow your CLV and drive sustainable growth and profitability. Schedule a demo today.