- Platform

- CleverEssentials

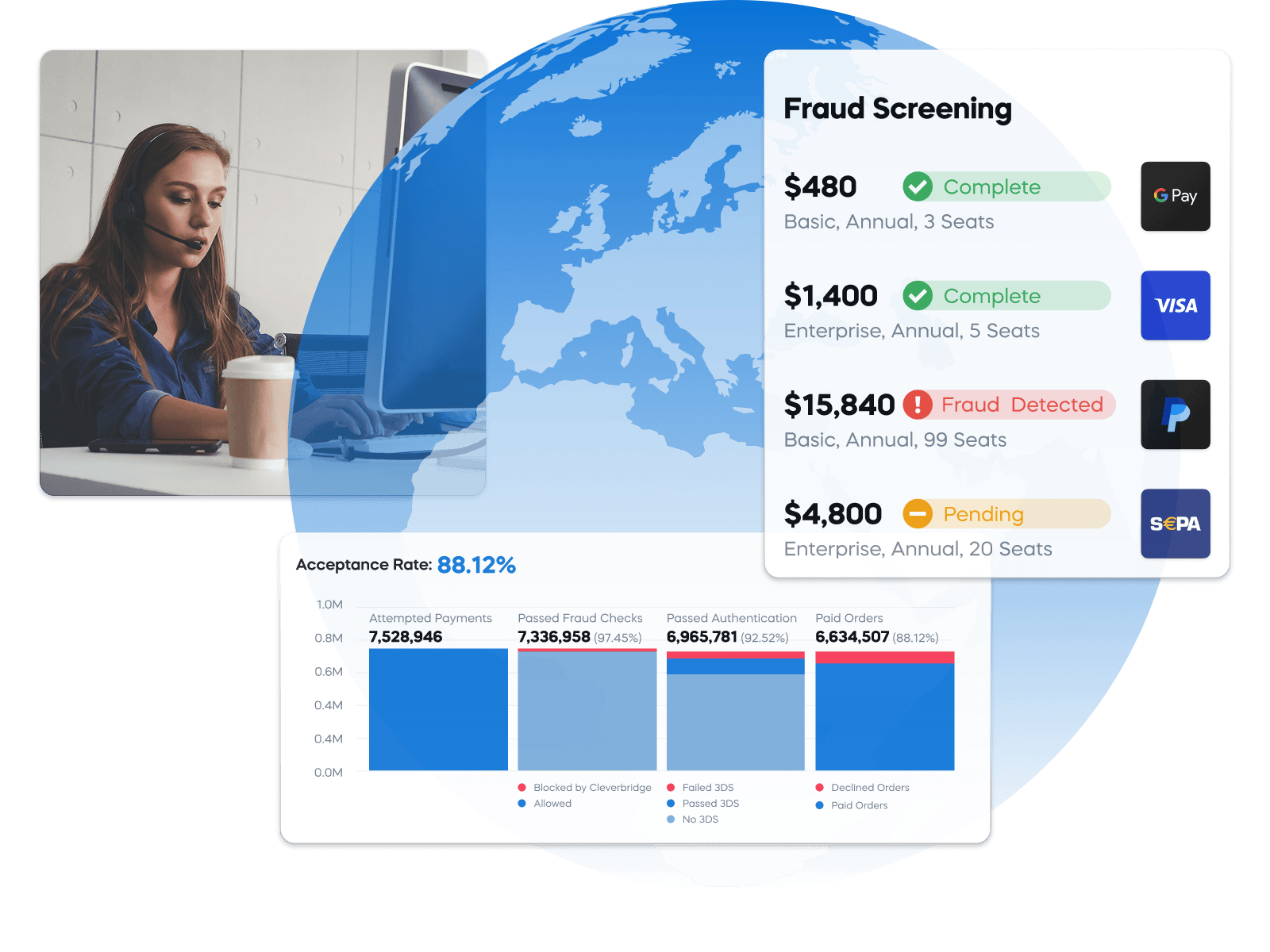

- Fraud Prevention

Stop fraud without killing conversions

Protect your business with accurate and automatic fraud prevention built for global transactions.

Powering the world’s best companies

Features

Effective fraud prevention at scale

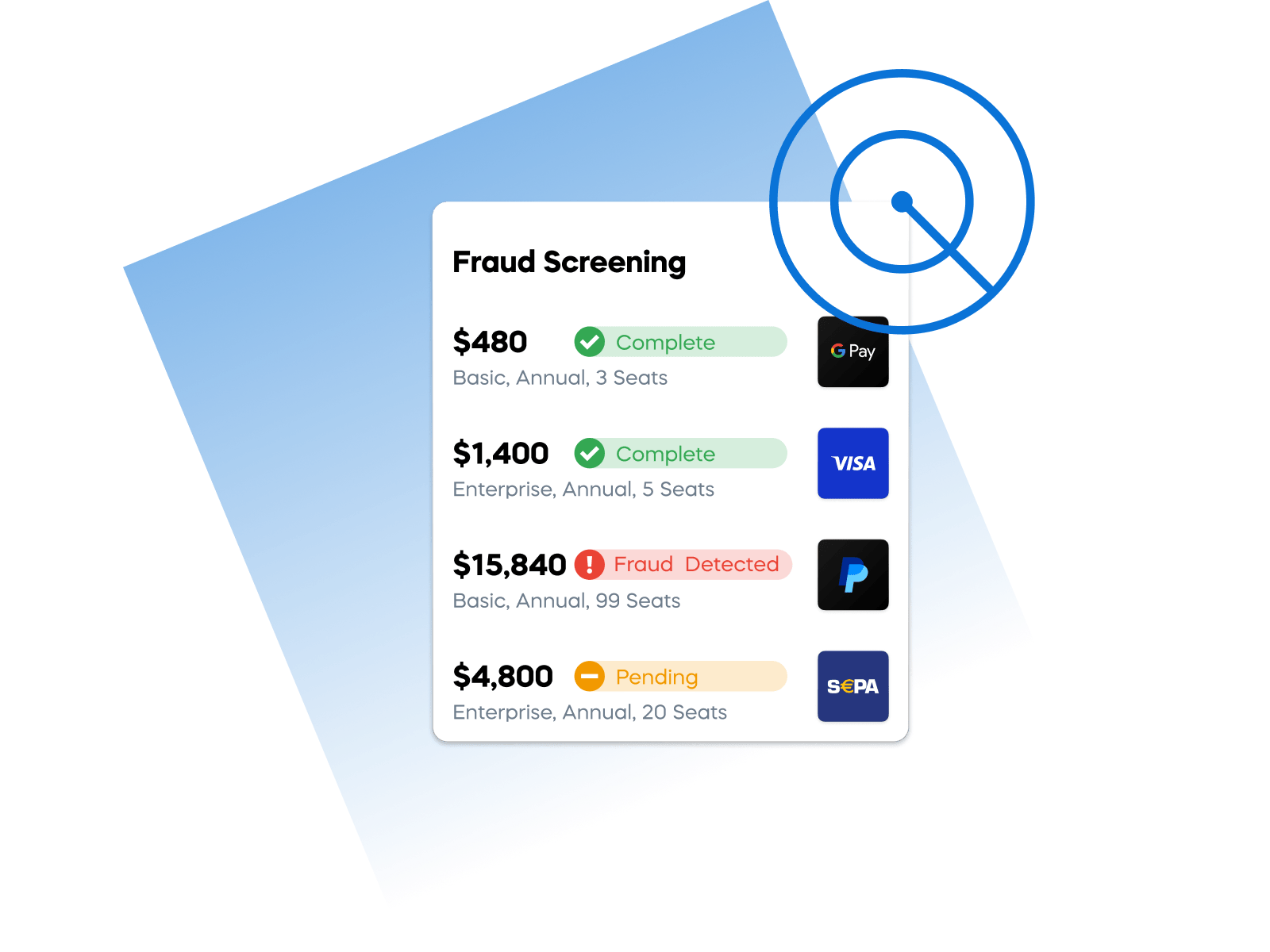

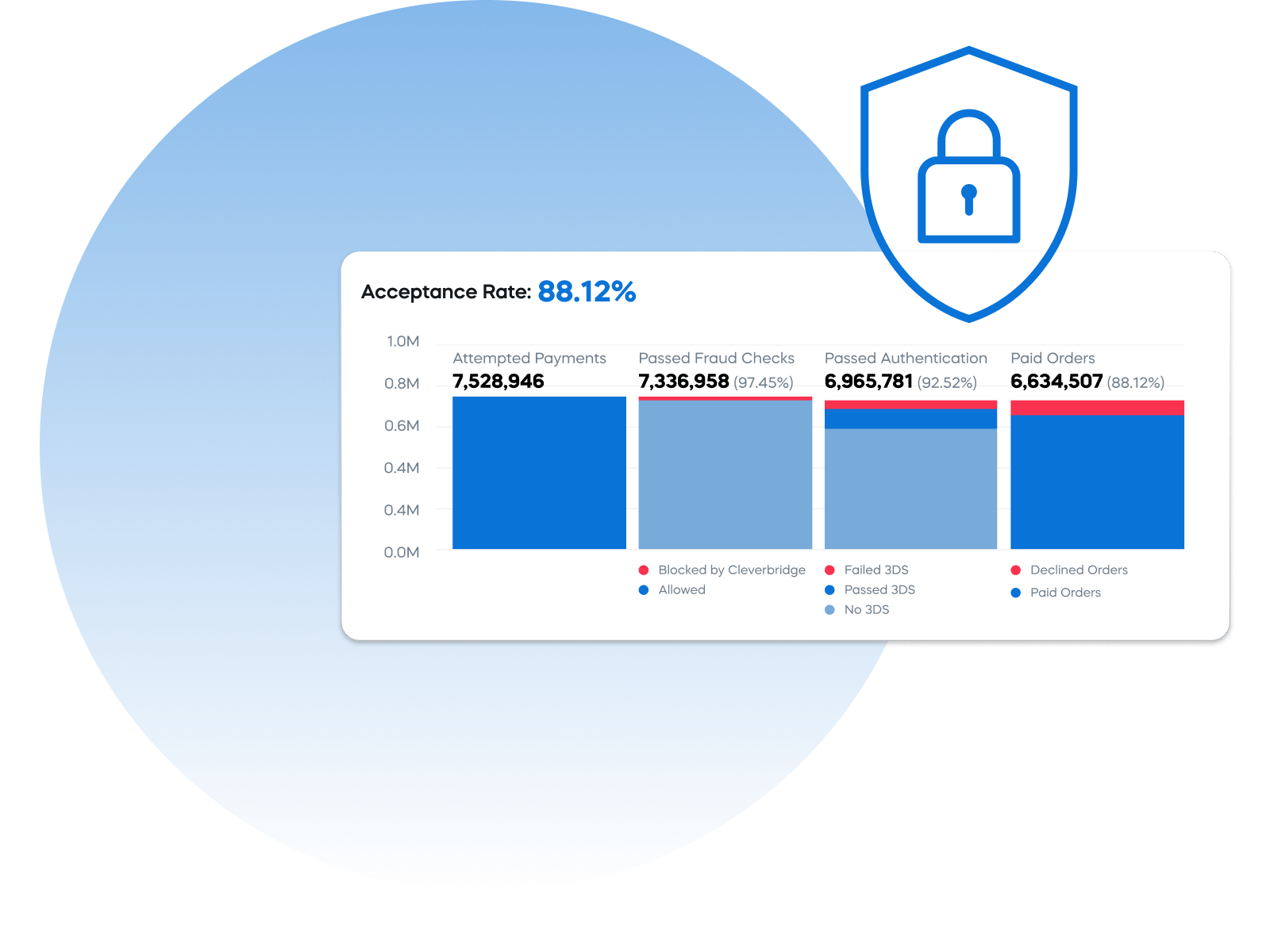

AI-driven fraud detection

Catch fraud faster with a machine learning engine that improves with every transaction.

- Adaptive fraud scoring based on buyer behavior

- Pattern recognition across thousands of data points

- Optimized to prevent false declines and missed fraud

- Continuously trained on global transaction data

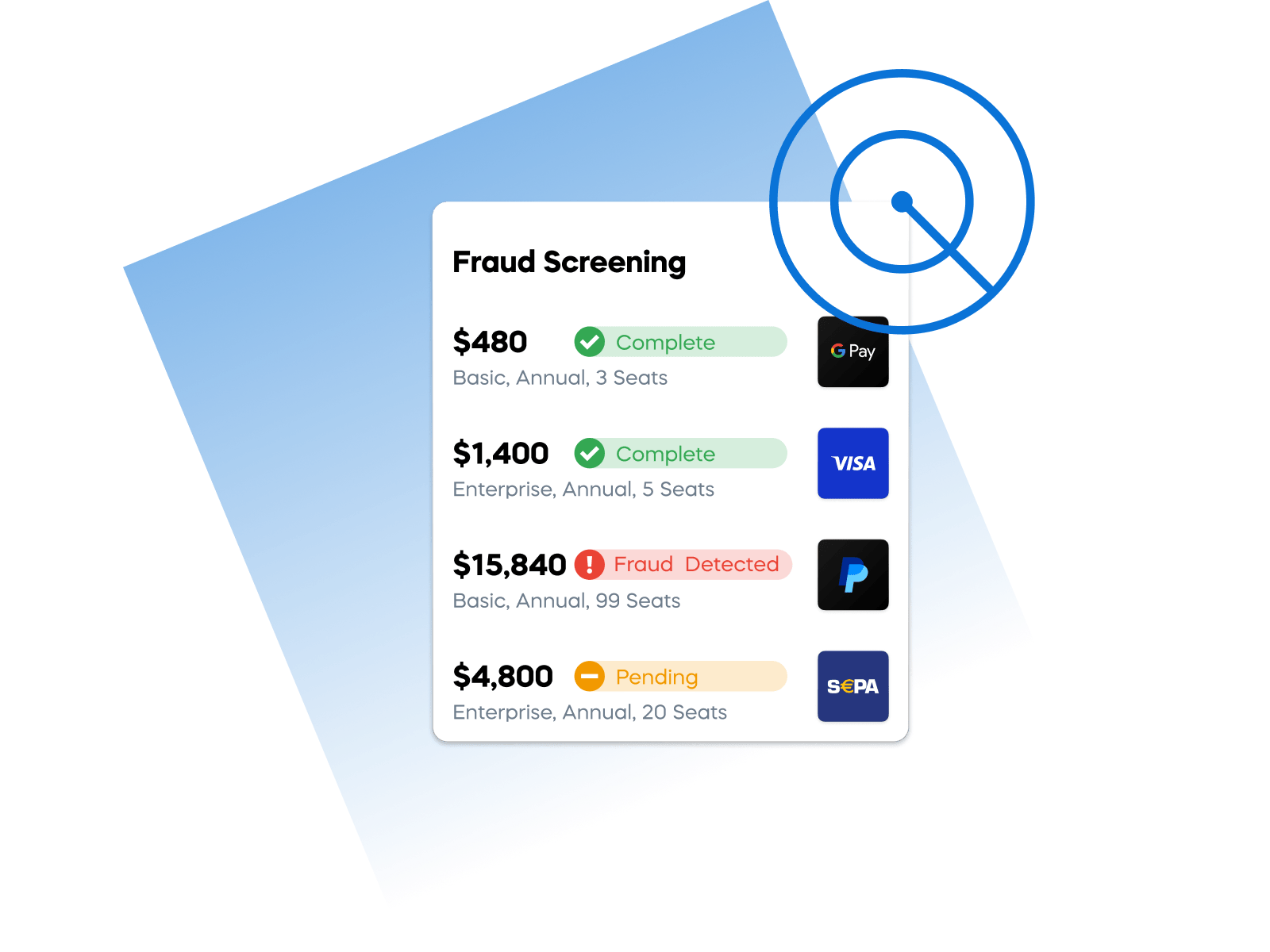

Manual & rules-based screening

Pair human expertise with flexible logic to stop edge-case fraud before it happens.

- In-house fraud team actively reviews suspicious orders

- Custom rules per product, region, or customer type

- Flags high-risk signals for deeper inspection

- Adjusts thresholds based on industry trends and spikes in fraudulent activity

Shared fraud intelligence

Benefit from 20+ years of global fraud learnings across the Cleverbridge client base.

- Access to a vetted global fraud database

- Continuously updated with verified fraud patterns

- Share risk signals like IPs, emails, and domains

- Prevent repeat fraud across multiple client ecosystems

Chargeback protection & dispute management

Reduce chargebacks and recover lost revenue without draining internal resources.

- Proactive order refunding to stop disputes before they happen

- Chareback monitoring and full dispute handling

- Automated alerts and resolution workflows

- Multilingual customer service that defuses issues early

Learn more

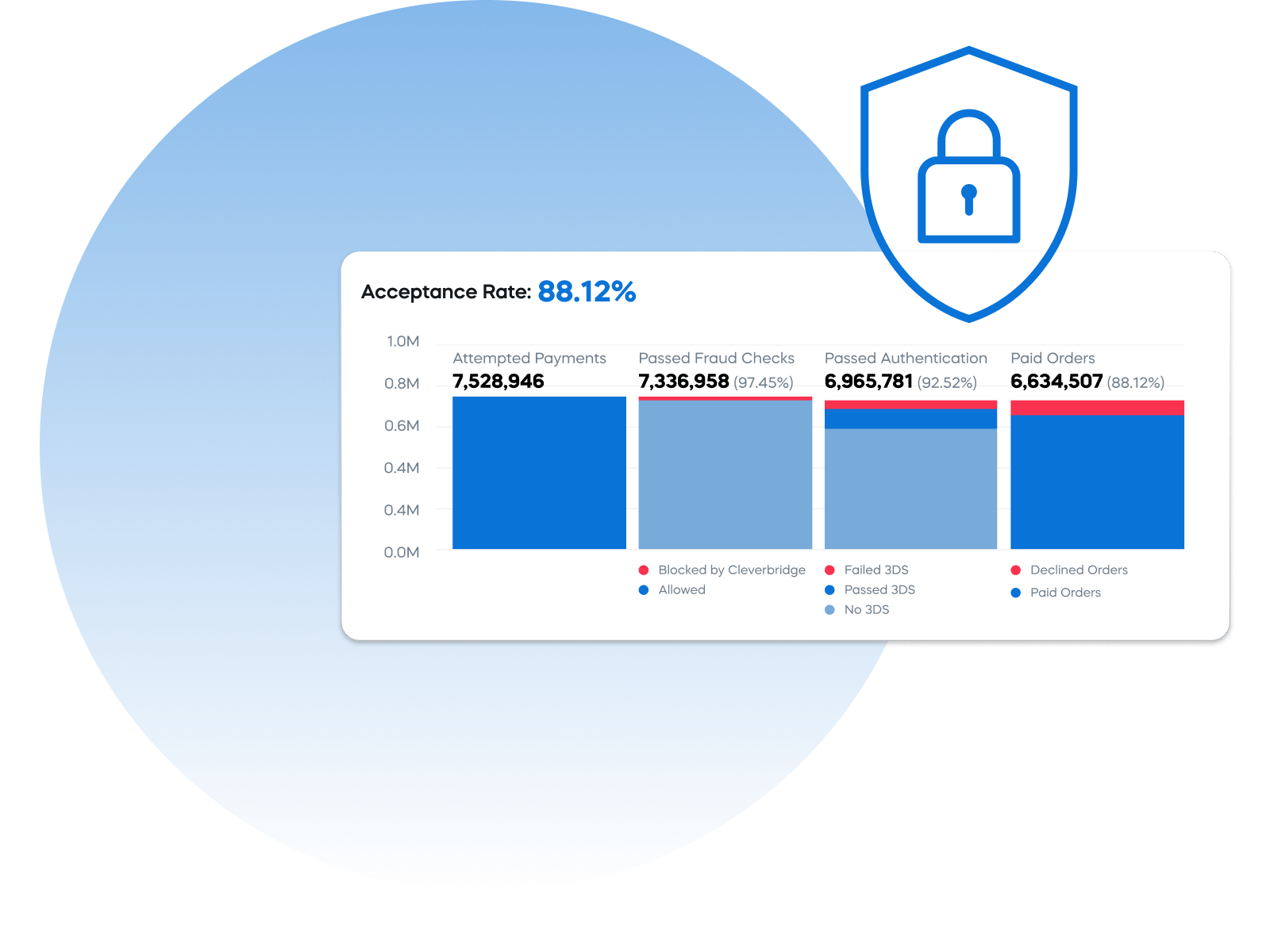

Enterprise-grade security & compliance

Protect data and meet global standards for privacy, security, and regulatory readiness.

- PCI-DSS, GDPR, and CCPA-compliant infrastructure

- Annual ISAE 3402 audit and SOC-aligned controls

- Multi-factor authentication and access management

- Built-in encryption, tokenization, and data minimization

FAQs

We use a hybrid AI and rules-based fraud engine backed by 20 years of expertise to detect and prevent fraudulent transactions in real time.

In addition to AI-driven monitoring, we have an in-house fraud team that manually reviews transactions, reducing false declines and optimizing payment success rates.

Yes. We maintain shared fraud lists that flag known bad actors across our global client base.

Yes. We offer full chargeback dispute management, proactive refunding, and representment for fraud-related claims.

Yes. We’re certified for PCI DSS and ISAE 3402, and fully compliant with GDPR, CCPA, and other global regulations.

Learn