- Platform

- CleverEssentials

- Tax & Compliance

Automate global taxes & compliance

Offload tax handling, compliance enforcement, and international regulatory coverage.

Powering the world’s best companies

Features

Stay compliant without the complexity

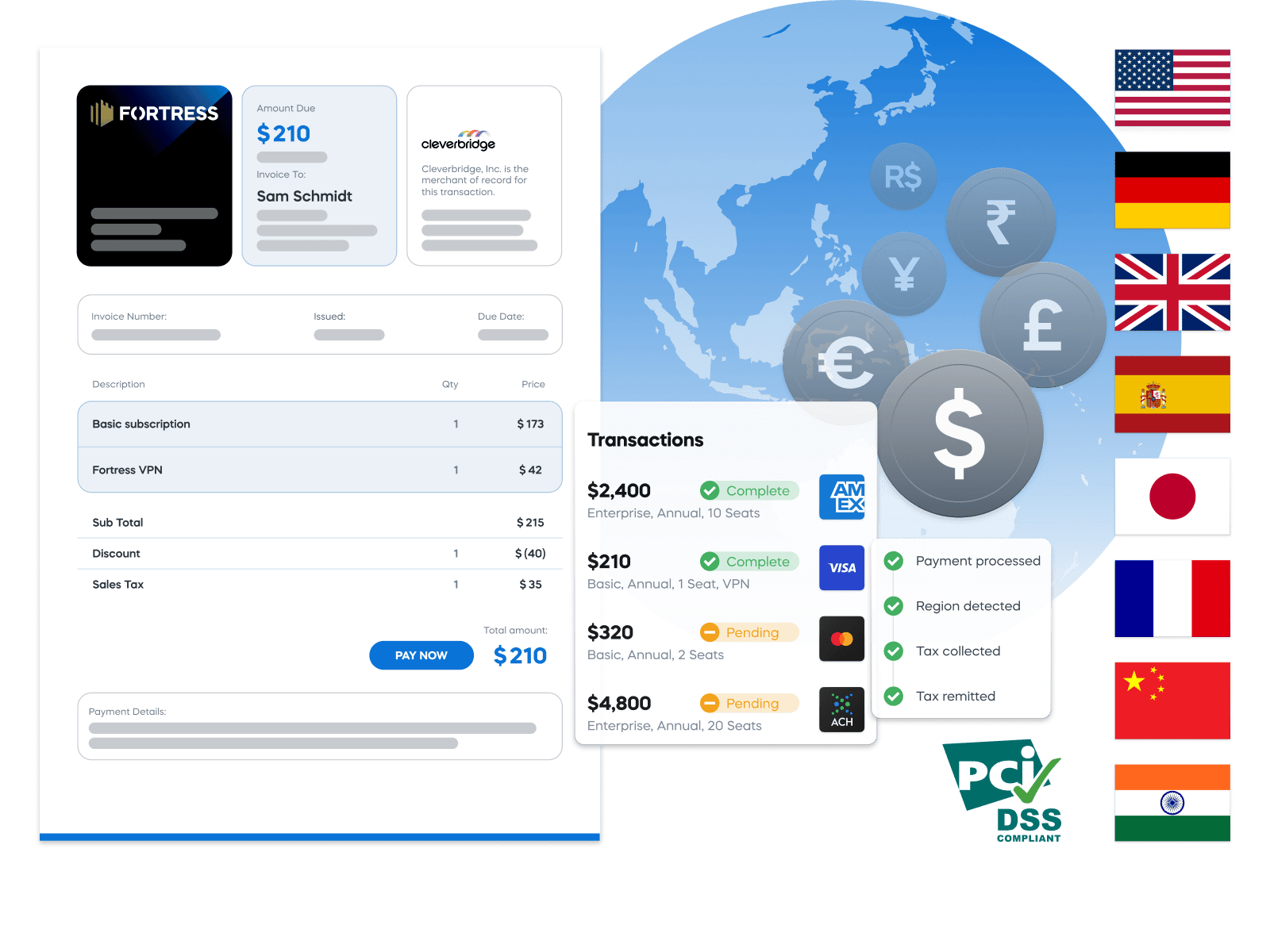

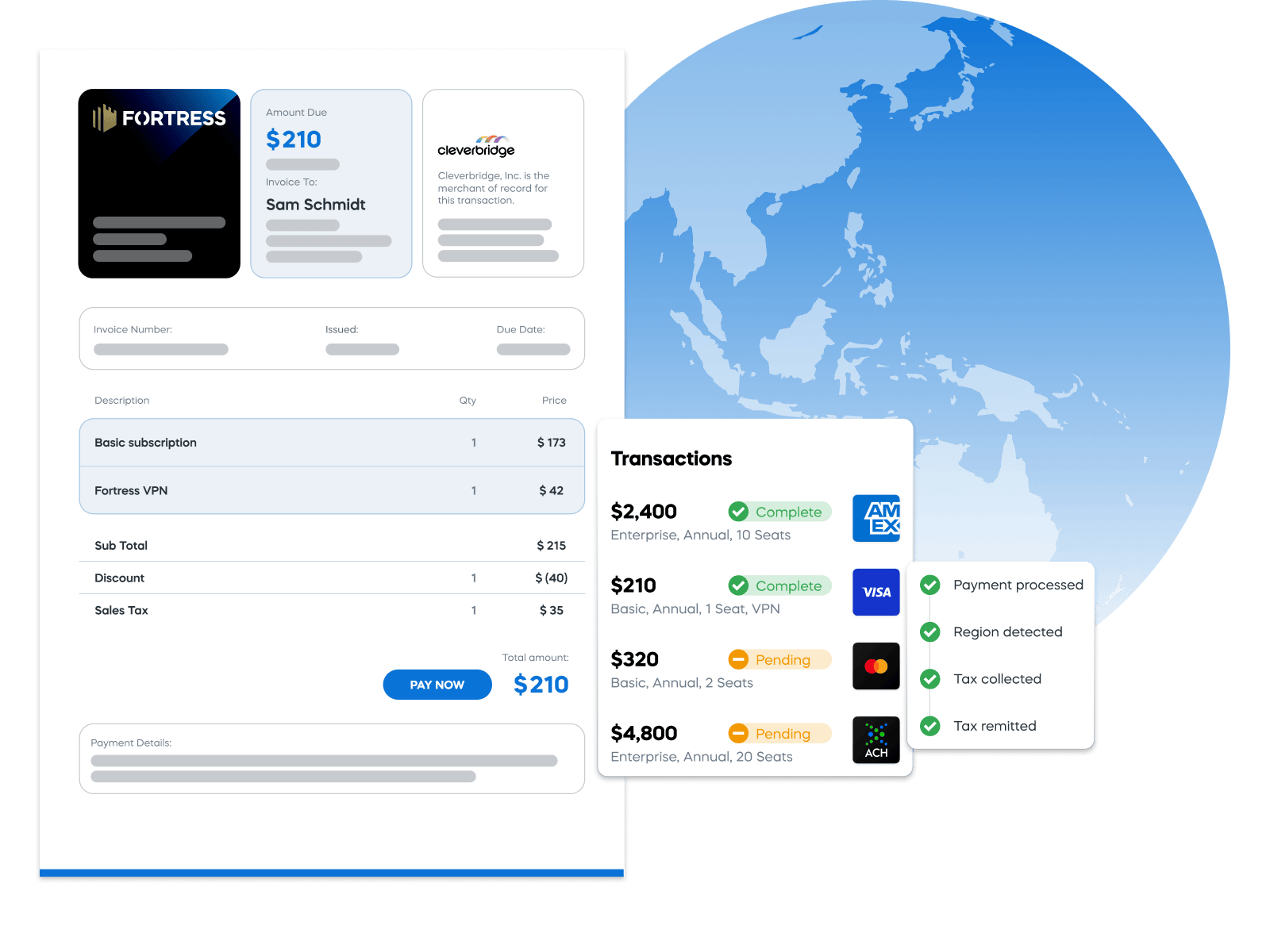

Automated global tax management

Take care of VAT, GST, and digital tax obligations without lifting a finger.

- Global tax registration, calculation, and collection

- Automated filing and remittance in 240+ markets

- Real-time tax logic by product and location

- Seamless integration with ERP and accounting systems

Automated global compliance coverage

Protect your business with built-in privacy, security, and regulatory compliance.

- GDPR, CCPA, and PCI-DSS compliant

- ISAE 3402 certified infrastructure

- OFAC sanctions monitoring to block restricted transactions

- Protects against fines from embargoed country violations

Continuous tax & compliance monitoring

Adapt automatically to ever-changing global tax and regulatory environments.

- Real-time monitoring of tax rule changes

- Updated tax logic for new markets or products

- Ongoing compliance with local legislation updates

- Managed by in-house legal and tax experts

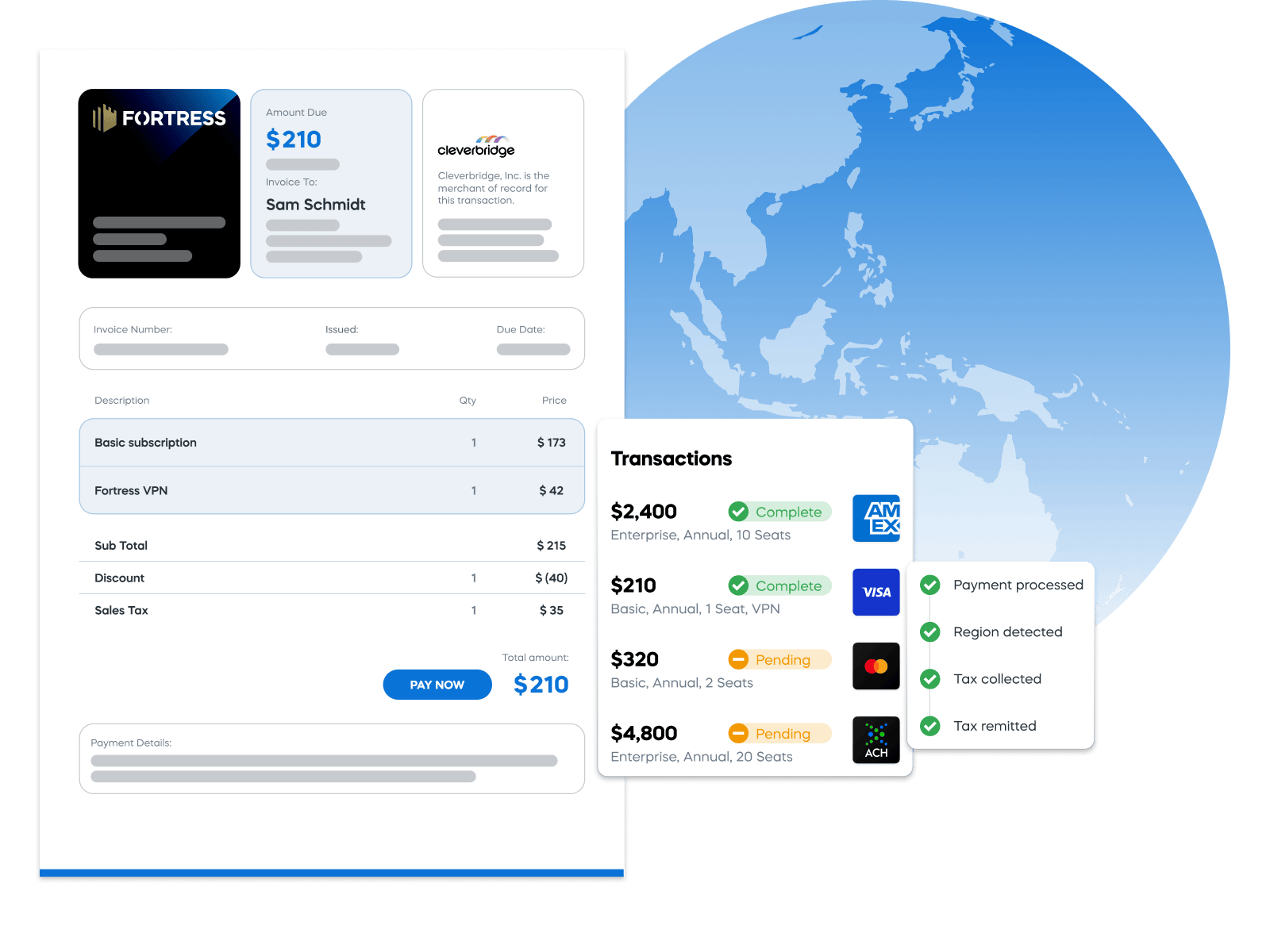

Tax-compliant invoices

Generate accurate, audit-ready invoices for every transaction, anywhere.

- Support for VAT, GST, and digital tax frameworks

- Invoices are dynamically adjusted based on buyer region

- Includes required fields for global jurisdictions

- Accepted by corporate finance and government authorities

Tax-exempt purchases made simple

Let buyers submit, validate, and reuse exemption documents without friction.

- Self-service exemption form at checkout

- Manual review and validation by our specialists

- Auto-generated exemption ID for repeat purchases

- Support for email-based exemption requests

FAQs

Cleverbridge calculates, collects, and remits VAT, GST, sales tax, and other regional taxes across 240+ markets.

Yes. Buyers can upload exemption forms during checkout and reuse their exemption ID for future purchases.

Absolutely. We generate fully compliant invoices based on buyer location and applicable tax laws.

Each transaction is automatically checked against denied parties and sanctions lists at both the account and SKU level, preventing regulatory violations.

Yes. We’re certified for PCI DSS and ISAE 3402, and fully compliant with GDPR, CCPA, and other global regulations.

Learn