Providing your customers with their preferred payment options is crucial to the success of any online business, particularly for B2B consumers. …

Listen to this article

Cleverbridge and Adyen partner to power the next generation of global commerce. Read the announcement

Providing your customers with their preferred payment options is crucial to the success of any online business, particularly for B2B consumers. …

Written by

Share this post

Subscribe for best practices on optimizing your software business.

Listen to this article

Providing your customers with their preferred payment options is crucial to the success of any online business, particularly for B2B consumers. Research shows that 48% of B2B cart abandonment stems from consumers being unable to pay with their preferred payment option.

This statistic underlines that B2C buyers are presented with many payment options, including credit cards, digital wallets, and even cryptocurrencies. In contrast, B2B buyers struggle to find their preferred payment option, and the reality is that 90% of B2B transactions still take place offline. As perplexing as it sounds, 25% of B2B transactions in the US are still paid by check, with 20% of these being technology-related purchases – staggering, considering that Gartner expects 80% of B2B sales interactions between suppliers and buyers to occur in digital channels by 2025.

Credit card payments currently make up the majority of B2B online payments. While they certainly serve a purpose, ACH or Automated Clearing House has established itself as a viable and more attractive alternative for B2B buyers and sellers. ACH is the natural successor to the archaic check system, is cheaper than traditional payment methods, is processed faster, offers more security for merchants and buyers, and leads to fewer chargebacks.

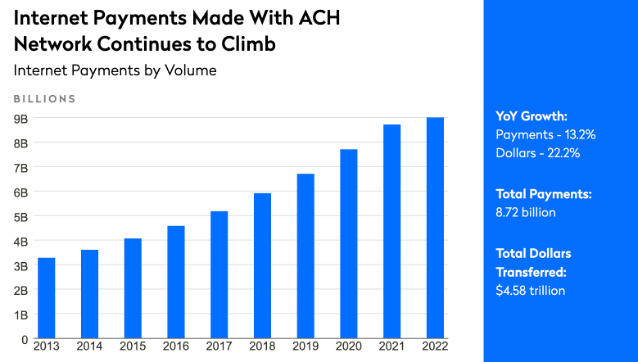

ACH has established itself as the go-to B2B payment method in the US, with almost 20% YoY growth and a volume of $9.35 billion in online payments in 2022. ACH processes payments over an electronic network connecting banks directly with one another versus being routed via a third party. According to recent PYMTS research, ACH is the preferred payment method for the SMB segment in the US.

Why should you consider adding ACH to your payment setup?

If you’re already selling online but only offering credit cards as a payment option, you are likely missing out on some B2B customers and involuntarily leaking revenue–ultimately negatively affecting your conversion rate. Don’t miss out on the 48% of B2B buyers who did not complete a purchase for their companies because their preferred payment method wasn’t an option.

It’s time to get on the ACH train—the next stop is increased B2B customer lifetime value and revenue growth.