The B2B Buyer Disconnect

Founder & CEO of TrustRadius Vinay Bhagat joins us in this Q&A to share his thoughts and research on the radical disconnect between B2B …

Written by

Share this post

Subscribe for best practices on optimizing your software business.

Listen to this article

Founder & CEO of TrustRadius Vinay Bhagat joins us in this Q&A to share his thoughts and research on the radical disconnect between B2B buyers and the organizations that are trying to sell to them.

But first, a primer on B2B buyers…

- 60% of all B2B technology buyers are millennials (ages 25 – 39).

- Research by TrustRadius, Bain & Co., and others show there is a huge gap between the expectations of today’s B2B buyers and what B2B marketers are doing.

- Gen Z and millennial buyers are almost twice as likely as older generations to discover a product by searching online.

- B2B buyers consistently use these top five information sources to make purchasing decisions: (descending importance)

- Product demos

- Vendor/product websites

- User reviews

- Vendor reps

- Free trials/accounts

- 57% of buyers make purchase decisions without ever talking with a vendor representative.

- 45% of buyers use reviews during their purchase process, while only (20%) of buyers use analyst rankings and reports.

- 87% of buyers want to self-serve part or all of their buying journey.

Given my focus on the evolution of B2B sales & marketing, I’m a big fan of the research TrustRadius regularly publishes, such as their most recent report, the TrustRadius B2B Buying Disconnect, which is the catalyst for this interview. The B2B Buying Disconnect is an annual research report that reveals year-over-year changes in business technology buying and selling. The data in this year’s study comes from a survey of 1,134 technology buyers and vendors conducted in September 2020.

This report highlights the fact that B2B buyers, their expectations, and their behaviors have changed radically – and B2B marketers have not caught up. Today, there is a yawning gap between how tech companies market to B2B buyers and the actual needs and wants of these buyers.

Doug: How did you start TrustRadius?

Vinay: I’m a serial entrepreneur. While I was with my previous company, we bought a lot of enterprise technology. The procurement process was really problematic. In one particular case, we bought a complex piece of HR tech and rolled it out only to find it was a poor functional fit. We had consulted the Gartner Magic Quadrant, talked to vendor-supplied references, validated functionality with the account rep, but still made a mistake.

Evaluating other purchases we’d made, I realized that this wasn’t an isolated incident. Our evaluation process failed to uncover what the real product experience was likely to be for our business. Around the same time, I was purchasing a high-end coffee machine for my wife. I found a site called coffeegeek that had incredibly robust reviews. I thought it was crazy that something like that existed for a home appliance purchase, but I couldn’t find anything equivalent for a multi-hundred thousand dollar enterprise software purchase. So that’s what led me to start TrustRadius.

Doug: That’s an interesting story. What prompted me to ask for this interview was a recent report by Bain & Co. that highlighted the fact that B2B vendors are missing the tremendous importance of younger colleagues influencing B2B buying behavior. Your research, in fact, shows that millennials now constitute the majority of B2B technology buyers, and that the buying behavior and expectations are very different from the practices of vendors.

Vinay: Yes, 60% of enterprise purchases now involve or are led by millennials. So, millennials are really important. Peer advice in general is incredibly important. Vendors today underestimate the importance of peers in the buyer’s journey. They may use customer testimonials, but more often than not, the approach is to use a quote from a senior executive or a logo from a big brand. As a buyer, you want to hear from someone similar to you – who has a similar role and is at a similar company.

Secondly, you don’t just want a positive quote, you want a balanced account – the whole truth. You want to be able to dig in and understand the pros and cons and whether a solution will work for your distinct use case. That’s a fundamental disconnect in B2B marketing today.

Doug: So you’re saying B2B marketers are missing the boat in terms of marketing to the actual buyer and being relatable?

Vinay: Yes. Oftentimes B2B marketers think they understand that customer references and customer testimonials are important. But the mistake they make is they’ll slap a big brand logo on their site, they will put a single quote up from an executive, or a video soundbite.

And there are two issues with that…. One is it feels like marketing. It’s not wrong, but it’s just not authentic. And two, it’s not relatable. Let’s say I’m a prospective customer at a small brand, or I’m at a different level in the company. I want to hear from people I relate to: same industry, same company, same size, same level…

Millennials are heavily involved in purchasing, and they want to see quotes from people like them. Today, it’s the folks on the frontlines using the tools who are very involved in decision making. While an executive may have to sign off on the budget, they’re usually not the one doing the homework.

Doug: It seems like a major fail. Why are technology companies not already properly targeting their content to the right B2B buyer?

Vinay: We work with a number of brands who do get it. An example of a large, mature company who gets it is IBM’s Cloud Division. They understand that digital is transforming the world, and that customer voice is critical. Their product information pages are dynamically syndicating customer quotes from TrustRadius. They’ve built a carousel where a buyer can scroll and see quotes from 30+ customers from different industries and company sizes. They have found this strategy has massively improved engagement and conversion on those pages.

They also use the content to enable their sales team via Seismic. They have built a strong public presence on our platform which has helped them to double their audience exposure and positively influence buyers. They’re also thoughtful about how to use the data coming out of our platform to market, sell and renew more effectively. So certainly, there are some shining lights of companies who are doing it the right way. However, there’s still a good chunk of the marketplace that doesn’t get it yet.

Doug: Roughly, what percent of vendors are using customer reviews effectively already to support their sales process?

Vinay: 86% of technology vendors are working with one or more review platform in a commercial relationship. However, the majority are still not doing it right today. Most simply buy a profile and view it as a passive lead source. Some are driving reviews, but not paying a great deal of attention to the quality of content they’re generating nor if it tells the right story. Far too few, perhaps 20% of brands, understand that the content that’s created through reviews is a strategic weapon that should be used in their own channels.

Companies like IBM Cloud, or AlienVault, in the security space, have fully embraced the fact that their customer’s voice is fundamentally what the buyer wants. They’ve been effective at using their review content, breaking it into sound bites, and then making it pervasive across their digital channels – on product or industry information pages, on lead forms, in email campaigns, and enabling their sales team with that content.

Winning vendors feed buyers exactly what they’re looking for. And that concept extends beyond reviews. Customers also want early access to demos and trials. It’s about adapting to what the buyer wants. The buyer wants to self-serve as much as possible. The buyer wants control, and the buyer wants to hear from their peers. Vendors who understand that, and those who strategically embrace that change, will differentiate themselves.

Doug: That’s interesting. Have you seen any ROI calculations by companies using peer reviews as part of their marketing and sales process?

Vinay: Absolutely. On average, brands that use our review syndication capability on a lead form see a 30% improvement in conversion. The high watermark has been about 150%. If you’re spending paid media dollars to drive someone to a lead form, if you could get even just a 20% lift in conversion, that’s very material in terms of financial outcomes.

We’ve had companies like IBM Cloud see about a 30% lift in engagement on pages that have that syndicated content. That engagement is measured by time on page and scroll depth. The reason that’s valuable is that people are spending more time with your brand.

The SEO impact is really interesting. We have been able to make sure that the user-generated content that gets syndicated to a brand’s pages gets crawled by Google, allowing them to rank on additional keyword terms. We’ve turned on a capability where their star ratings – their score on TrustRadius – shows up in their organic search results.

One of the vendors we’re working with is seeing a 15% increase in traffic to their pages, where they’ve added the review quote syndication through both having again better user-generated content flow into those pages and star ratings show up in their organic search results. These are techniques that B2C marketers have used for years. A lot of what we’re doing is parlaying what is known and proven in the B2C world to B2B.

Doug: Vinay, are there companies in addition to IBM that you might highlight as being particularly effective at this?

Vinay: Yeah, there are many. Matillion, a company in the data transformation (ETL) space, uses their TrustRadius Top Rated badge in addition to dynamic review syndication on landing pages. They’re seeing a 70% improvement in conversion. They have also used a capability that we provide called Category Audience Targeting, where they’re able to advertise to high-intent buyers in their category, shopping for their product, or competitor’s products, or related products in the cloud data warehouse category. They’re able to concentrate their ad spend on buyers who are in market, and drive about a 2.5 times conversion rate compared to general display and search based advertising. So certainly, there are many companies who are doing things right.

Doug: So what types of vendors are the early adopters in using peer reviews and better targeting the millennial buyer? It seems like Product Led Growth (PLG) companies in terms of free trials or freemium offerings, and the consumerization of the buying experience would be a natural fit, right?

Vinay: Yes, certainly PLG companies are adapting in ways like offering freemiums and free trials, which are all part of what buyers want to self-serve.

Product Led Growth companies might use social proof more for conversion optimization. Security vendor AlienVault increased conversion 43% on their trial page by adding a review syndication widget. For companies that have a more elongated sales cycle, a customer voice strategy can still be very influential, again, giving the buyer what they want.

In classic enterprise sales, buyers often request to talk to your customers before they spend time in a formal evaluation. Because customer references are precious, they’re held back until a later stage in the sales cycle when the customer is “qualified” to talk to one of them.

In this new world, the buyer wants to have that perspective up front to know if it’s worth them spending any time on a buying cycle. Modern vendors are realizing that they have to give the buyer what they want. Yet, at the same time, they don’t want to overly tax precious reference customers. So having a robust library of social proof in the form of reviews and soundbites that they can spoon-feed to a prospect gives them what they need across their journey until the point they truly need an in-depth customer conversation.

Using the voice of your customers instills confidence and removes friction. You’re also going to differentiate yourself if you are using the voice of customers successfully and your competitors are not.

And then you need to be thoughtful about how to organize and structure the content so it’s used by your sales team and proactively to the customer through nurture through digital. Give buyers what they want at different touchpoints along their journey. And what we see as a result of using that customer voice along the way is improved conversion, deal acceleration, and improved win rates.

Couple that with using data intelligently. A platform like TrustRadius can give you a great deal of insight into what buyers are thinking. What we’ve learned in our research, and what others like SiriusDecisions (owned by Forrester Research) have demonstrated is that the buyer is well along the way to a purchase cycle before they engage with sales.

People talk about the “dark funnel,” not really understanding buyer activity. Are they spending more time with the competition or you? So even in traditional enterprise purchasing, there’s a massive transformation occurring in our industry right now where brands not only need to adapt to how the buyer wants to buy, but brands also have access to enormous intelligence that can help them engage and personalize.

To give you an example of how brands are using that data, WatchGuard, a company in the firewall space has fed True Intent data from TrustRadius into their account based marketing efforts. They spent $200 on an ad campaign that influenced over a million dollars in the pipeline because it was hyper-focused on buyers who are in the market evaluating them, versus casting an excessively wide net and wasting ad spend on people who aren’t buying today.

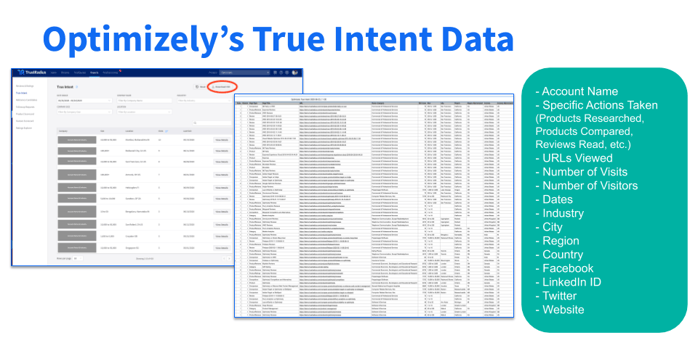

Another TrustRadius customer, Optimizely, feeds our True Intent data into Drift. They use the data to version the messages shown to buyers in the Driftbot on their website. If it’s someone who has not been on TrustRadius researching them, they’ll show their standard message. If there’s someone who has been identified as having done research on TrustRadius, they will ask if they would like to book a demo. They’ve seen material increase in conversion, boost in pipeline, and rapidly closed deals by using the data we have about where the buyer is in their journey to personalize the interaction.

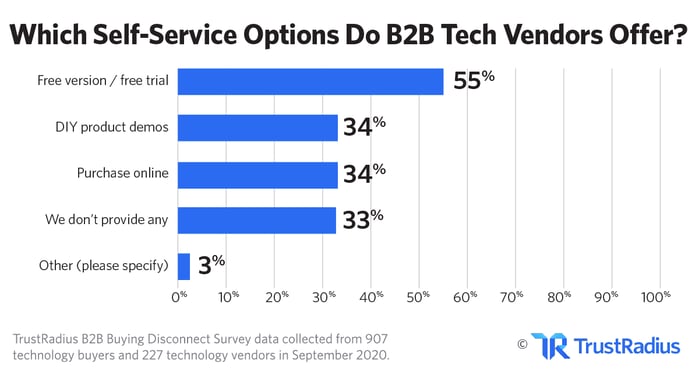

Doug: I’m fascinated by the disconnect your report highlights in terms of vendors not fulfilling the overwhelming desire of buyers for self-service. 87% of B2B tech buyers want self-service options, yet one-third of vendors don’t offer any kind of self-service, such as free trials, demos, and ecommerce. Why the disconnect?

Vinay: I think it’s, again, a question of how quickly brands have adapted to this desire of buyers to self-serve – and it isn’t just an SMB phenomenon. We see interest for self-serve with enterprise too. It isn’t just restricted to simple software, but also applies to more complex tools. There’s a desire to try before you purchase. I think brands have underestimated how important this trend is.

You talked about Product Led Growth, and that’s been one of the most important vectors of growth in the B2B software industry. A lot of companies are just wed to the old ways and have been slow to change. They need to realize that this is a transformative trend.

The software industry has gone through a number of transformations – moving from centralization of purchasing by IT to decentralization to business units, democratization from an executive purchase and a heavy relationship-based approach to more of a younger frontline person making decisions. Those young frontline people want to touch and feel the product, and hear from people just like them about their experience before they purchase.

What many brands have not realized is that this change has already occurred and is now pervasive. Millennials are doing 60% of the purchasing. Brands have not adapted to realize that millennials are important and shop differently, or that customer voice at matching levels of role and persona and company size, etc. are pertinent.

They haven’t yet embraced the fact that buyers want trials and freemiums and other mechanisms to tangibly feel the product.

Why do vendors still spend, billions of dollars a year with Gartner and traditional analysts, when all the data suggests that analyst reports are becoming less and less relevant to buyers? For millennials reviews are a facet of their everyday lives. They put a lot less stock in so-called expert analyst opinions.

I’ve spoken to CIOs who are still spending a million dollars plus on a Gartner subscription. But when you analyze the usage within the company of that data, it’s highly limited. The number of people who are really relying on that data is quite limited. They might look at the Magic Quadrant to build a shortlist, but they’re not using the reports to actually unpack whether one solution is right for them.

Doug: Is there a question you wished I had asked you?

Vinay: I think one of the things we try to unpack in the report was just the rising use of intent data. We’re seeing that about 40% of brands are using intent data. We’re in the first innings for the use of intent data. It’s interesting, it has been talked about a lot at B2B conferences, but the number of companies who actually know how to use it and build actions around it is still quite limited.

When you think about this new model – where buyers really don’t to talk to sales, and where half of buying committees never talk to sales, having intelligence about what those people are thinking and doing is critically important.

The analogy I use for True Intent data is, if you’ve seen the Tom Cruise movie, the Minority Report, where they have those kind of alien creatures, the precogs, who can predict crime, we predict sales through this intelligence we have about what buyers are doing and thinking. And I think it’s the new reality of how sales and marketing will get done.

You’ve already hit on the theme of buyer self-serve. That, to me is the biggest theme of this whole report is just how, how stark a trend that is. It’s no longer just the domain of a few PLG companies, like a Calendly, or a Slack. It’s become pervasive.

Those companies may have catalyzed the desire for trial products. But if you look at high-growth companies today, most of them have some kind of PLG-led component where someone can tangibly touch and feel the product.

Doug: How does this Minority Report vision play out in, say, the next 3 to 5 years in terms of vendors being armed with real insights from buyer intent data?

Vinay: It’s here, and now. It’s just that few vendors are really using it. The IBM Cloud team has started to pilot using buyer intent data to feed that data into sales, into marketing, and into account management. I’ll talk about account management, which is really interesting. Wouldn’t you like to know which of your customers are actively shopping for competitive solutions? And you’d want to know that for two reasons, one for retention, and two, if you’re a multi-product company for cross sell opportunities, where they may be looking for a competitive solution in an era where you have an offering?

The IBM Cloud team has improved net retention from 100% to 122%. By using that data strategically with their account managers, they’re able to engage accounts earlier and more effectively. On the new business side, they’ve seen a double in deal value and a compression in sales cycle time by arming their sales team with data not just about which companies are actively shopping, but also what products are they considering and the competitive set. It helps them know who they should be positioning against.

We work with a company in the project management space, who uses intent data to run very surgical advertising campaigns, so if they know they’re up against Asana or Monday, they will take that data and run a highly differentiated ad campaign that focuses on their advantages versus that competitor. So it’s about really being thoughtful and strategic about the use of that data to personalize marketing, and concentrate spend on people who are in market versus blanketing the whole market.

Choosing authentic voice-of-customer based messaging over marketing spin is critically important. The brands that will win are the ones using simple language. Don’t overcomplicate things and put customers front and center. Not just big brand logos. Make sure that there’s a smorgasbord of people and companies that people can relate to.

About Vinay

Vinay Bhagat conceived TrustRadius after experiencing challenges when buying enterprise solutions at his last company. He founded Convio in 1999, the leading SaaS platform for nonprofits. In April 2010, Convio became a public company, and was acquired in May 2012 for $325 million.

Vinay holds an MBA from Harvard Business School where he graduated as a Baker Scholar, an MS in Engineering Economic Systems from Stanford University, and a MA in Engineering Information Sciences from Cambridge University with First Class Honors. When he’s not working, Vinay loves playing with his kids, swimming and the occasional squash game. Find Vinay on LinkedIn and Twitter.

Sources and Suggested Reading: