- Solutions

- Sales

Quote, convert, and grow globally

Accelerate deal velocity and unlock new channels with quoting, invoicing, and partner tools built to scale.

Powering the world’s best companies

Features

Solutions that help you sell more

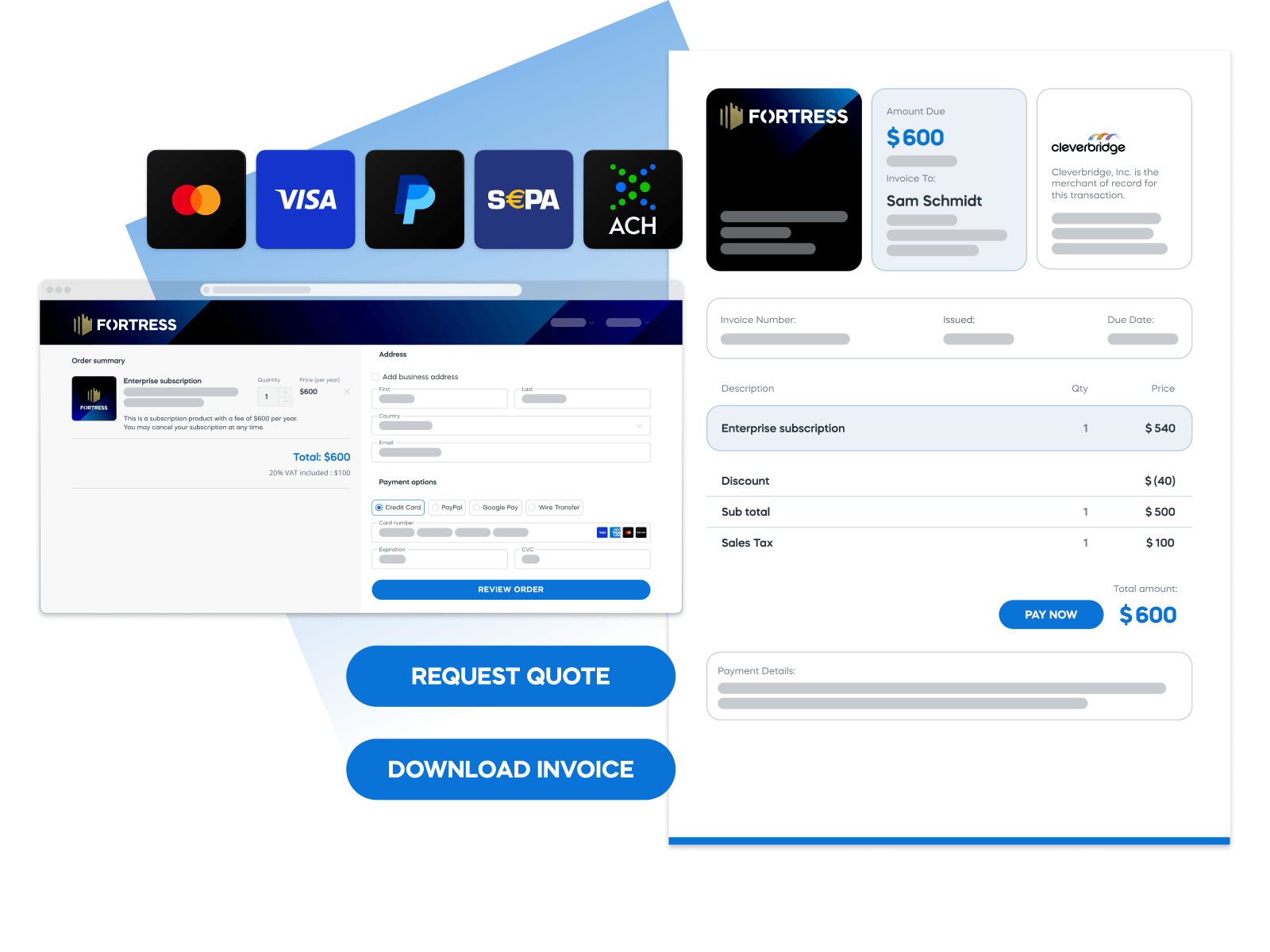

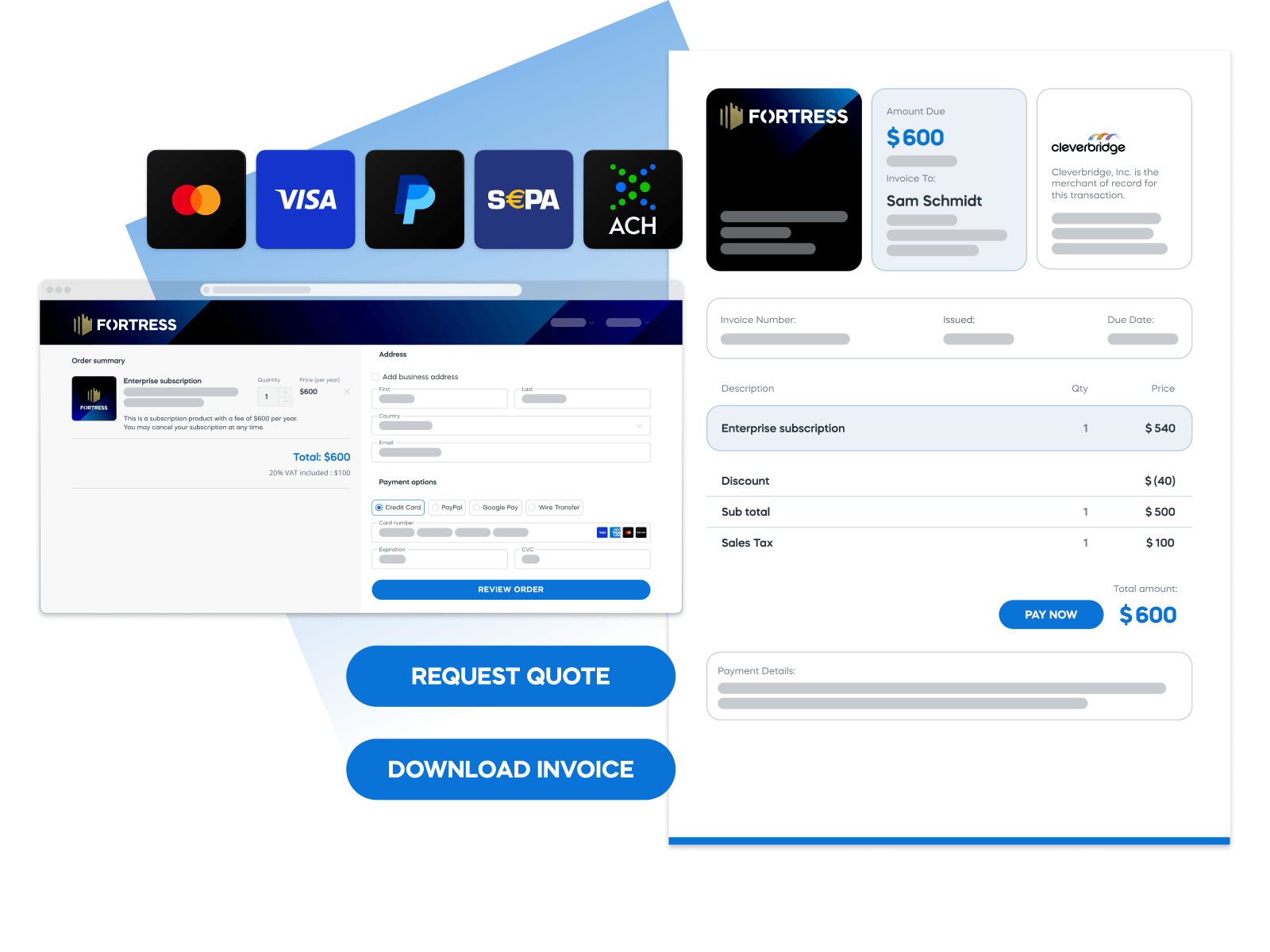

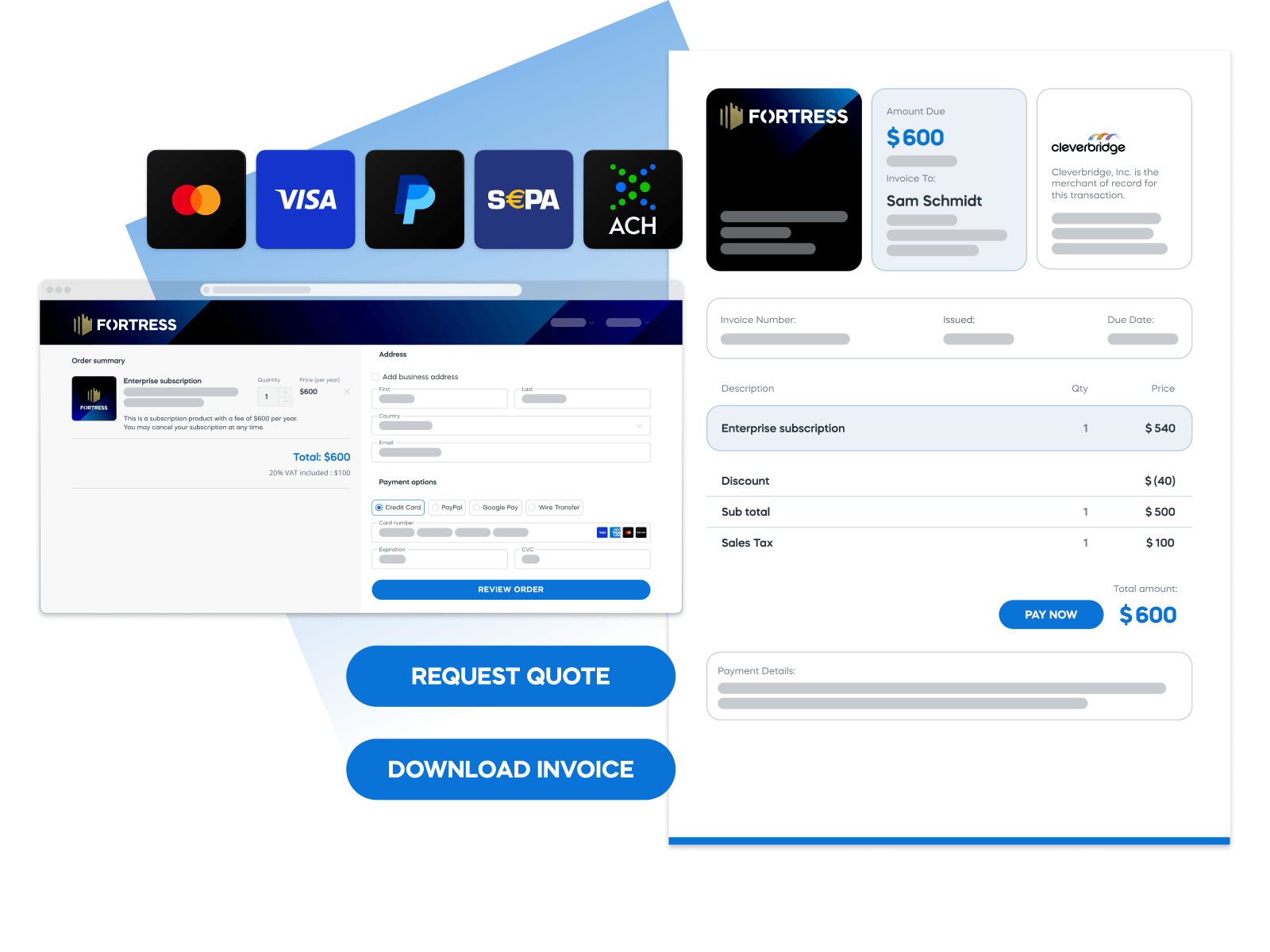

Quoting & invoicing

Accelerate B2B deals with CRM-connected quoting and flexible invoicing workflows.

- Quote-to-cart flows generated directly from your CRM

- Proforma invoice support for procurement approvals

- Multi-currency, tax-compliant invoice generation

- Automated invoice delivery and payment tracking

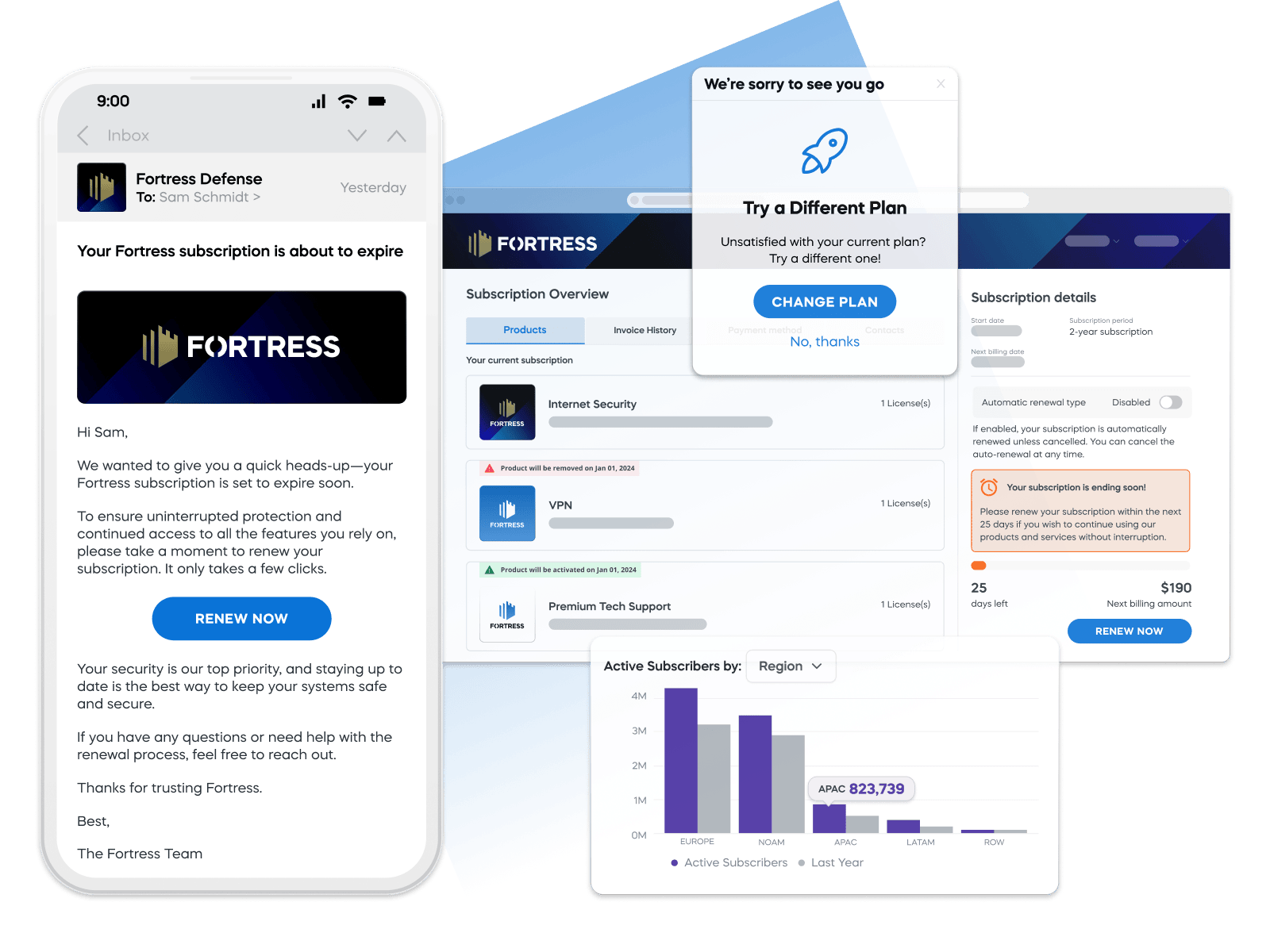

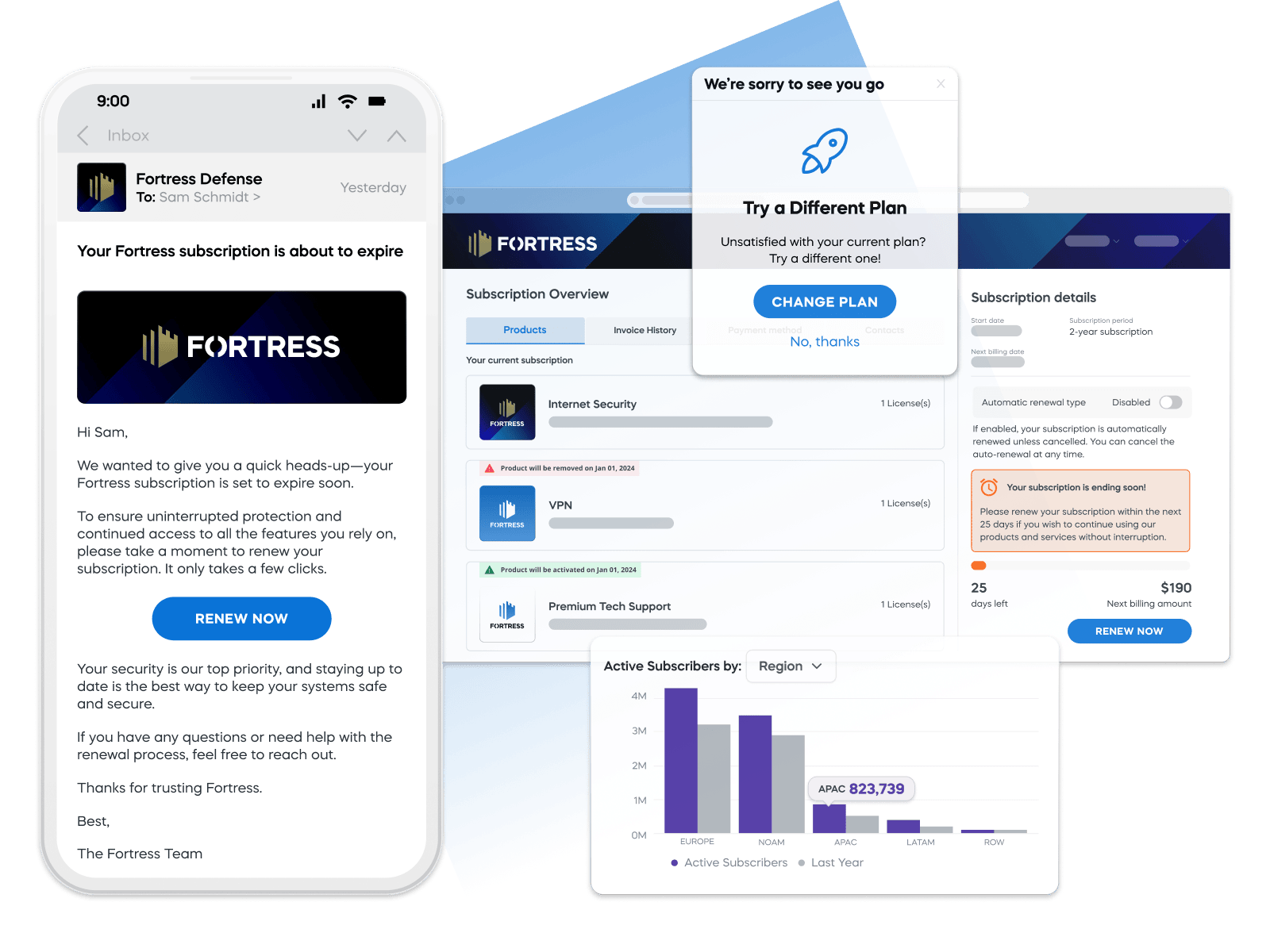

Subscription management

Support every deal type — from trials to usage-based pricing — with billing that scales.

- Fixed, seat-based, and usage-based pricing support

- Trial management and upgrade flexibility

- Co-termed billing for seamless expansion deals

- Customer self-service for plan changes and renewals

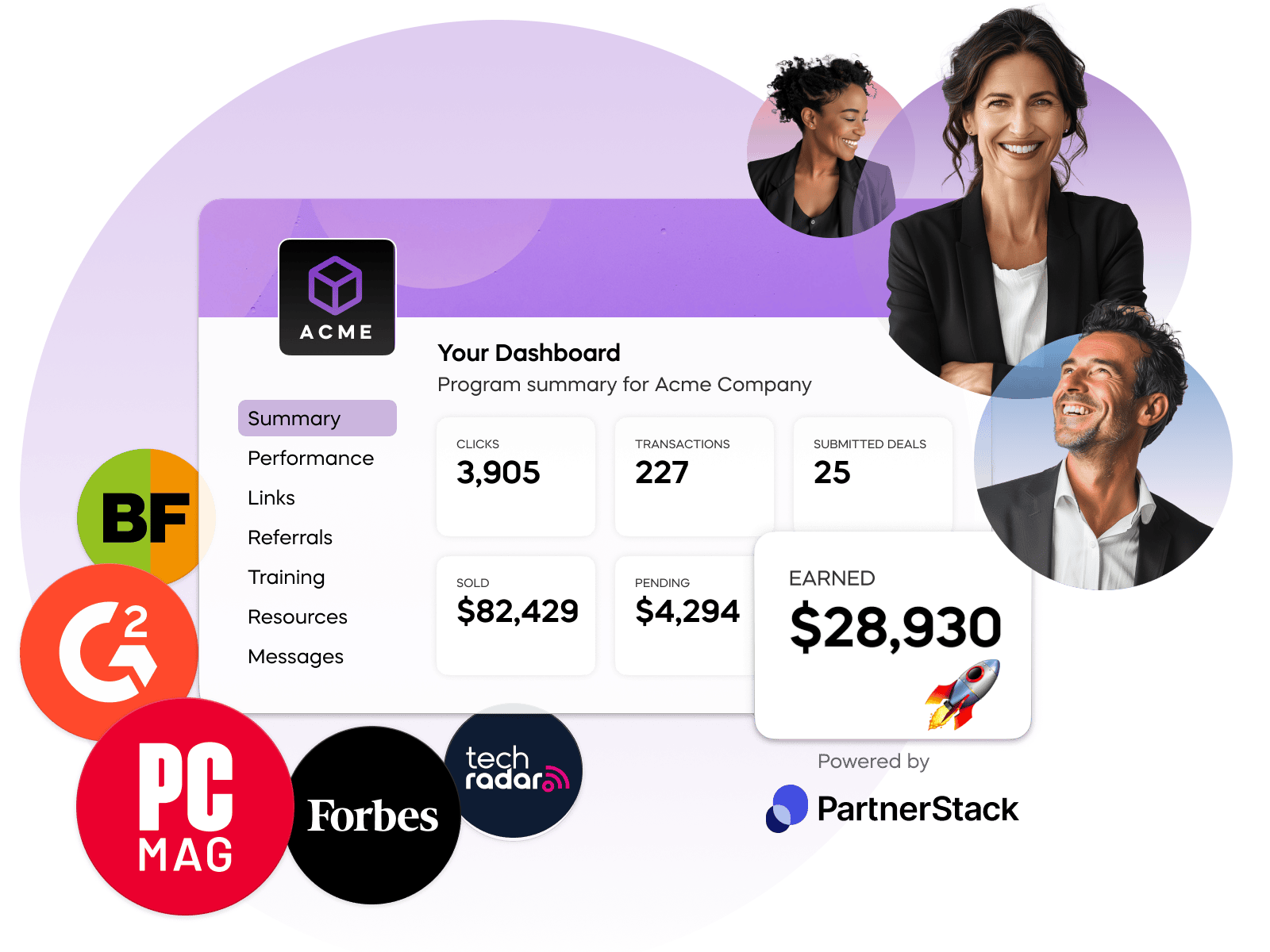

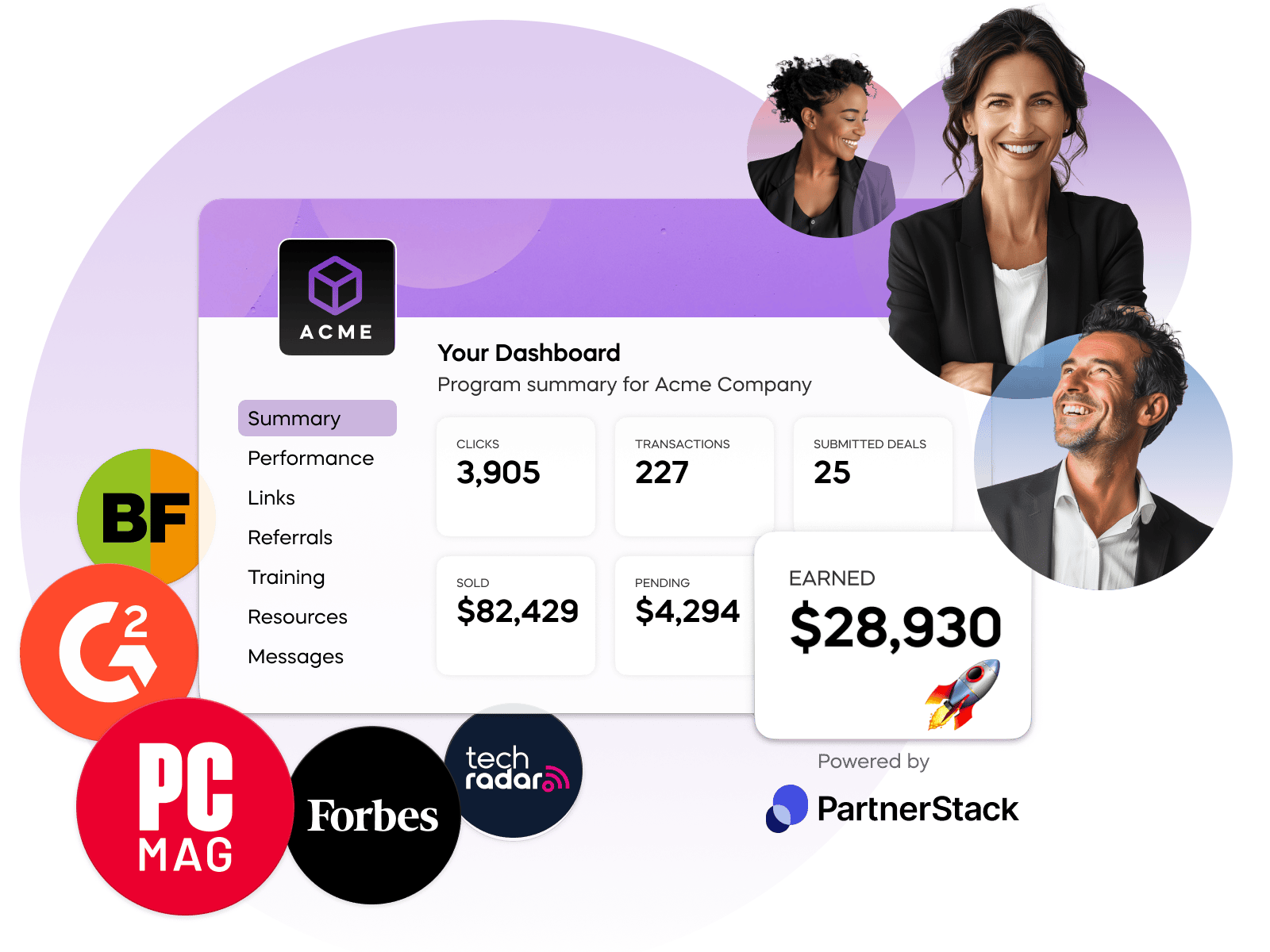

CleverPartners

Expand sales reach through affiliate, referral, and reseller channels.

- Access 100K+ B2B software and SaaS-focused partners

- Automate onboarding, commission payouts, and attribution

- Sell through PartnerStack, AWS, and Ingram Micro

- Track partner-led revenue from click to renewal

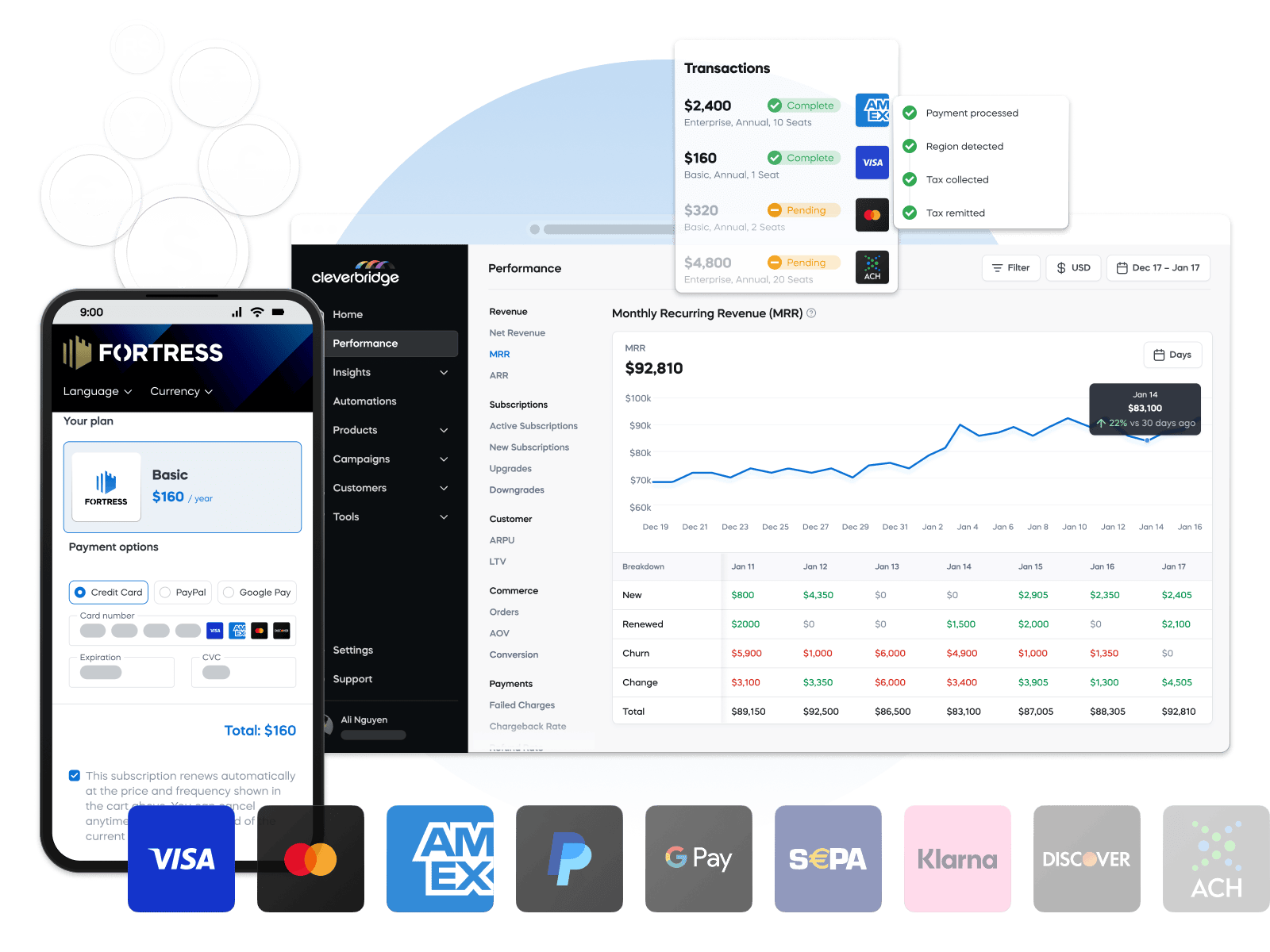

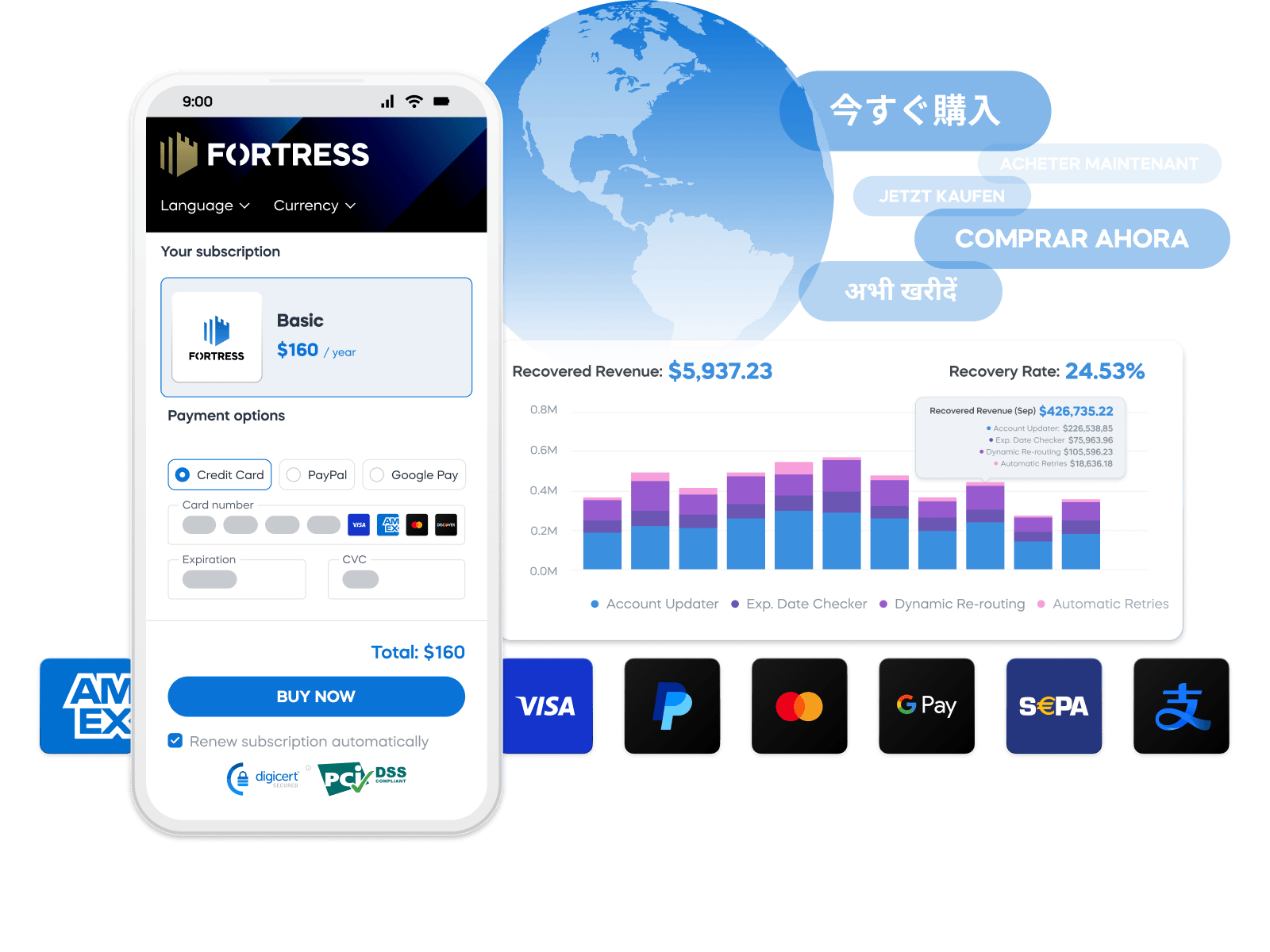

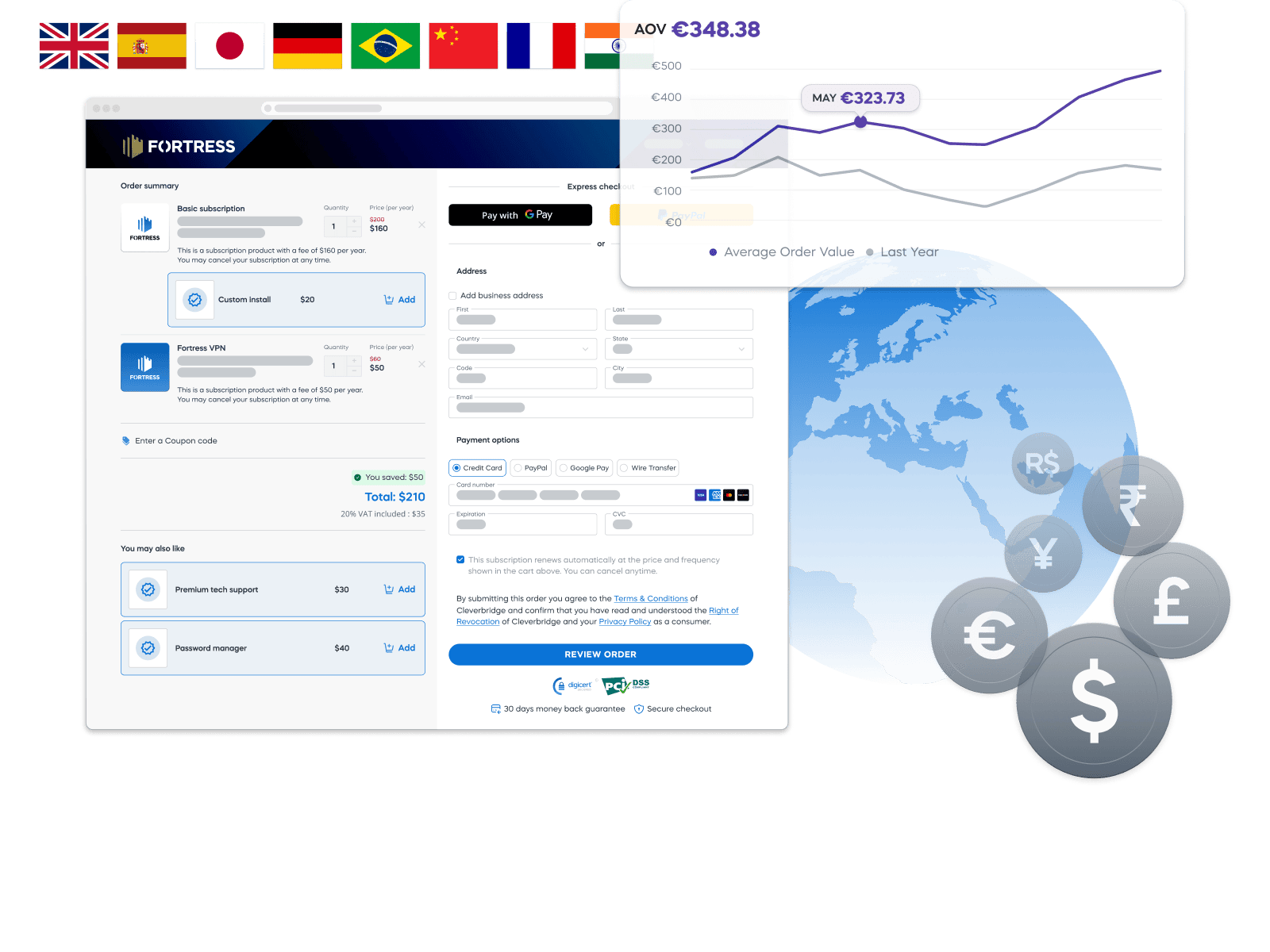

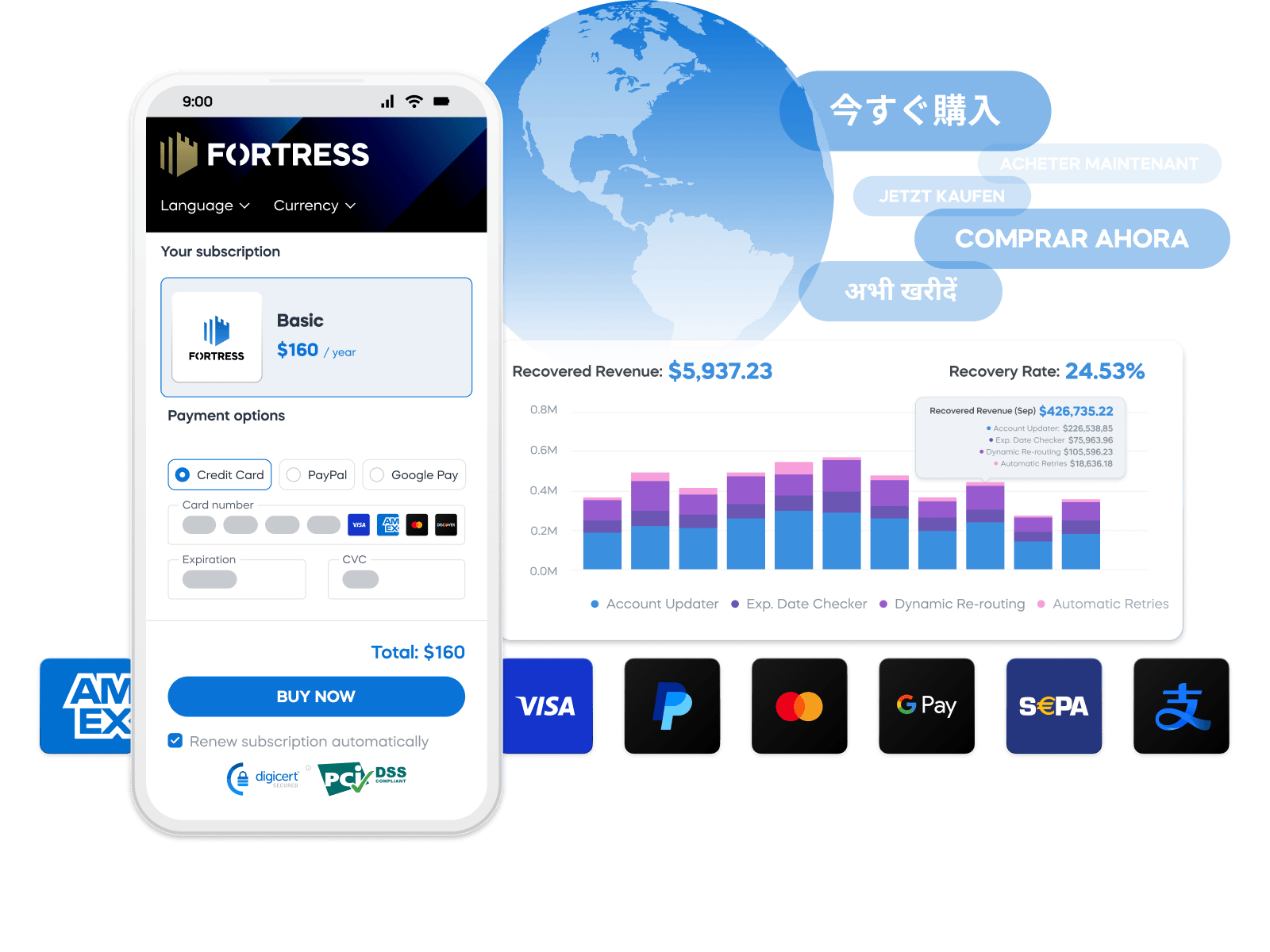

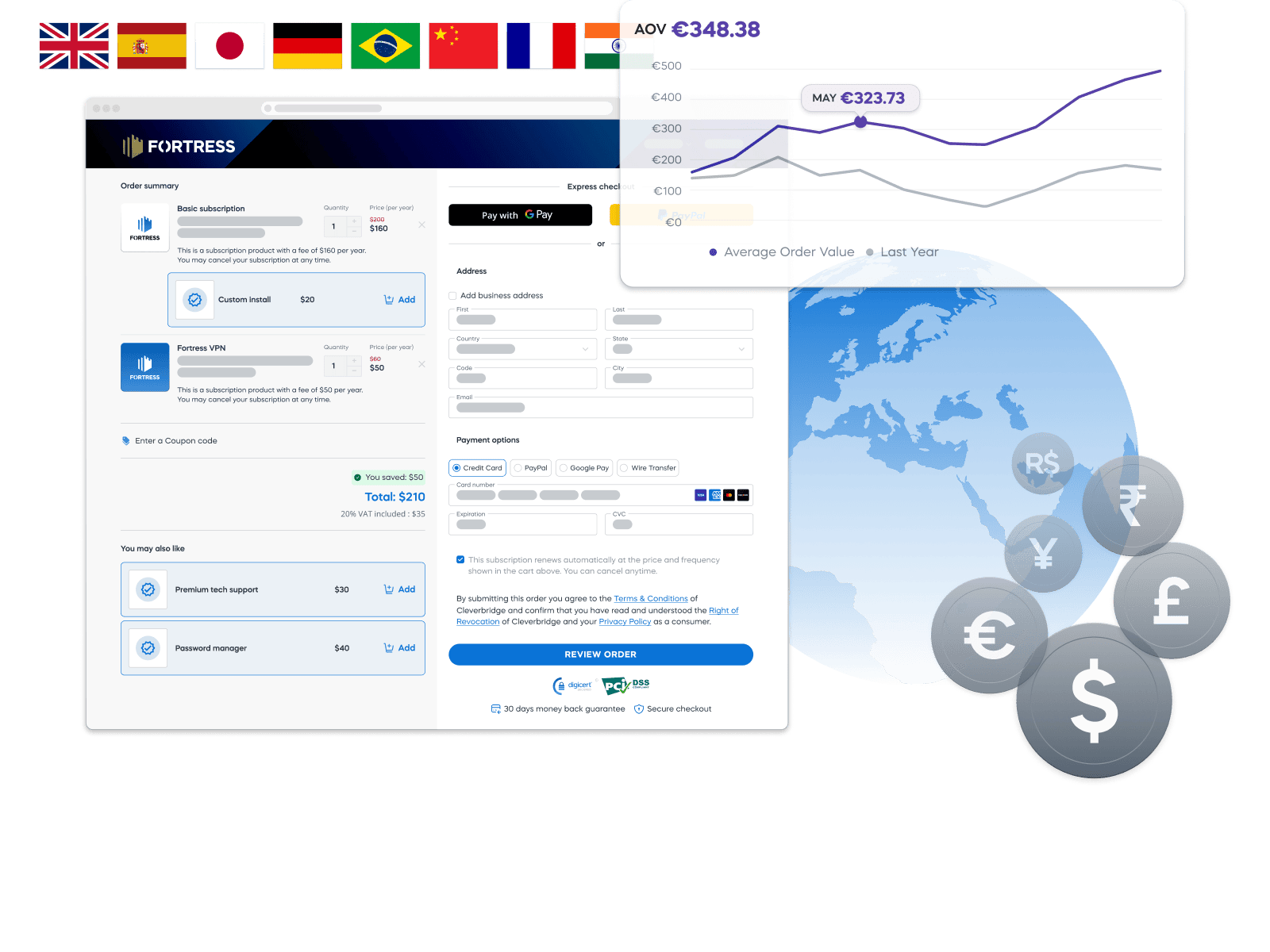

Global payments

Eliminate checkout blockers and improve conversion with localized billing.

- Accept 30+ payment methods and 59 currencies

- Smart retry and routing logic to reduce failures

- PCI DSS-compliant, tokenized payment infrastructure

- Seamless one-time and recurring billing

Optimized checkouts

Convert more leads by delivering fast, flexible, and localized checkout experiences.

- Embedded, full-page, and pop-up options

- Support for coupons, add-ons, and dynamic offers

- A/B testing to refine layouts and messaging

- Localized checkout fields in 30 languages

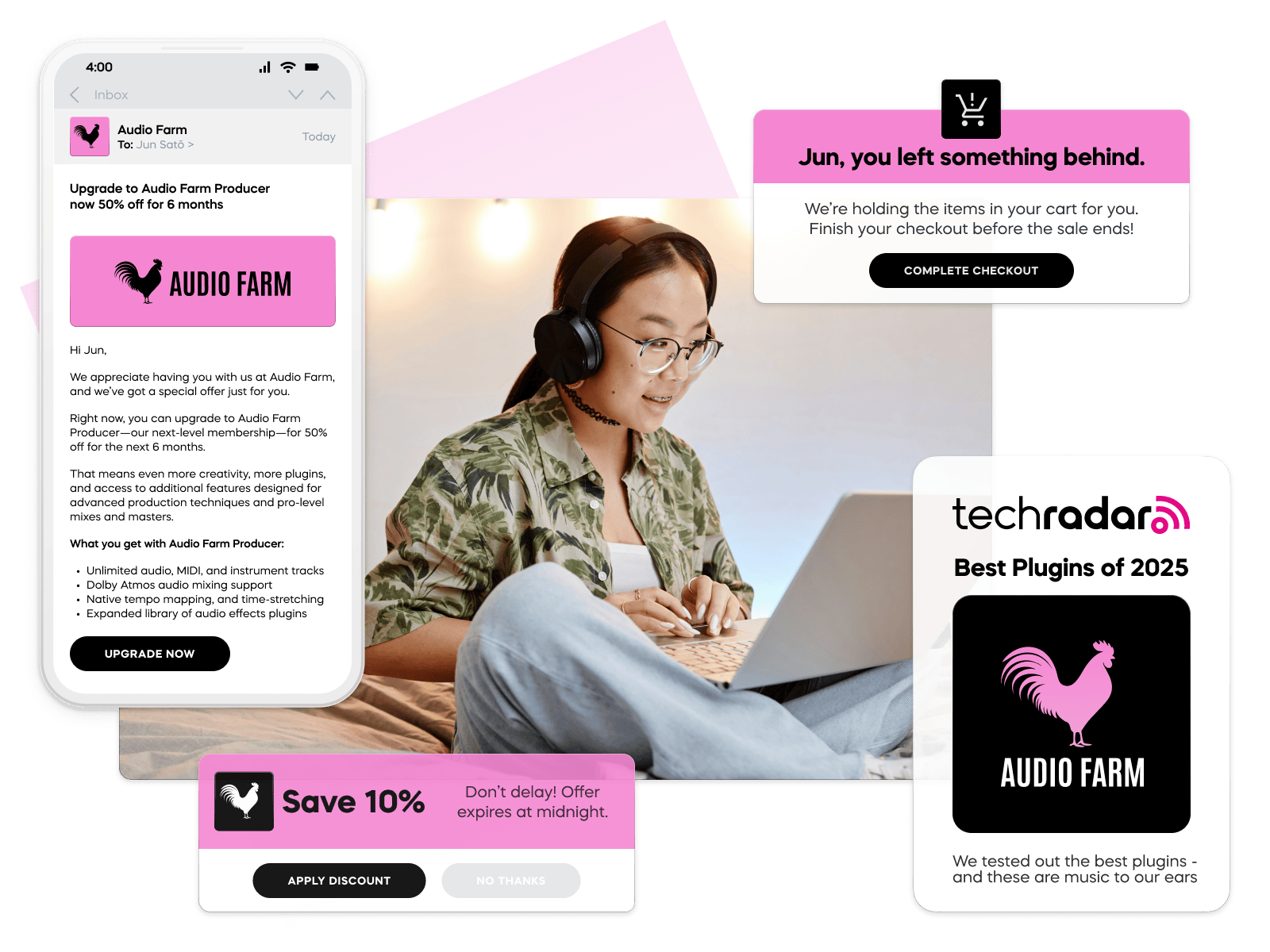

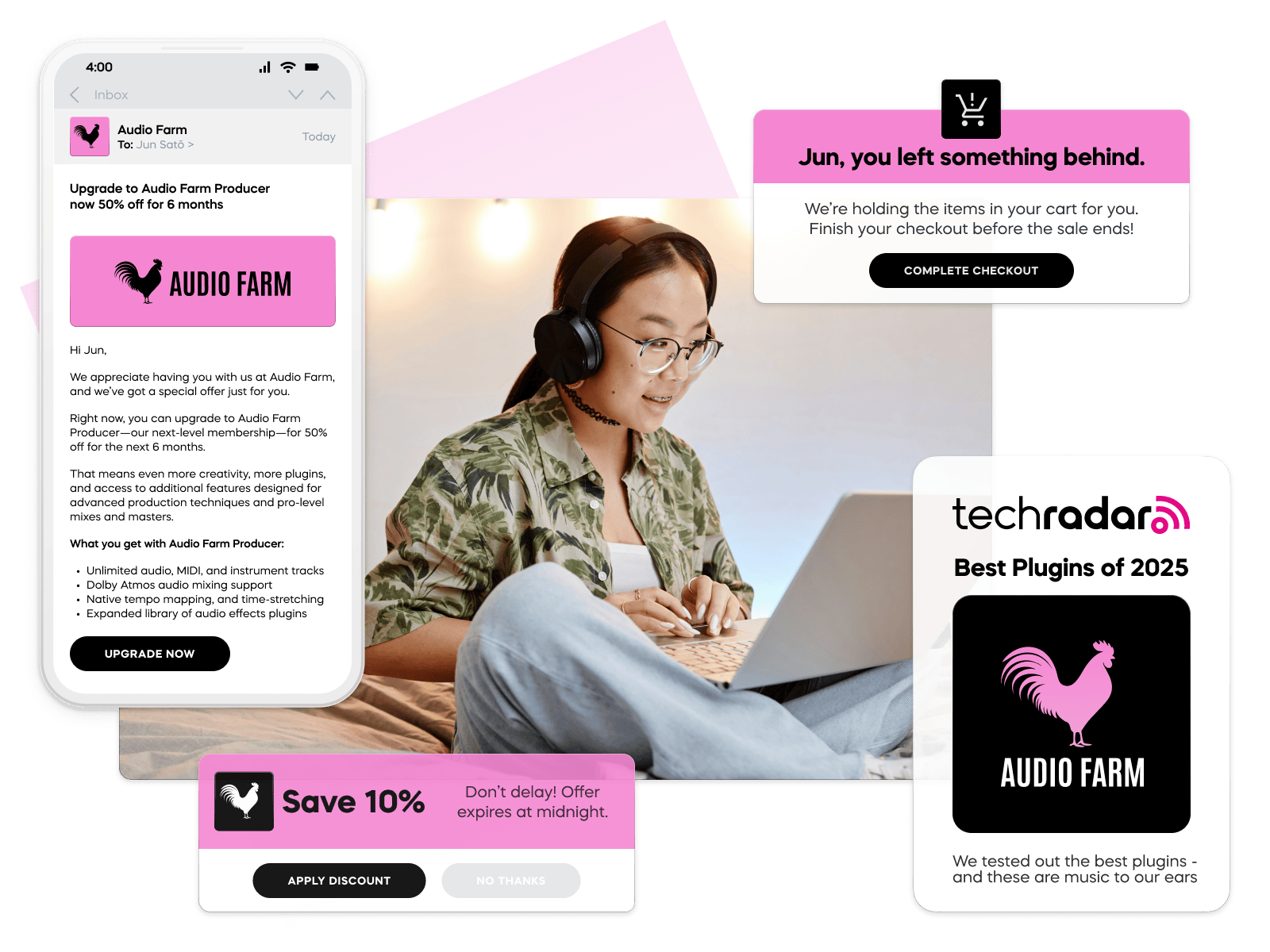

Digital Marketing Services

Increase lead-to-close rates with support from acquisition and conversion experts.

- Campaigns for affiliate-led acquisition and conversion

- On-site CRO testing and optimization

- Retention journeys that extend customer value

- Fully managed programs tailored to sales goals

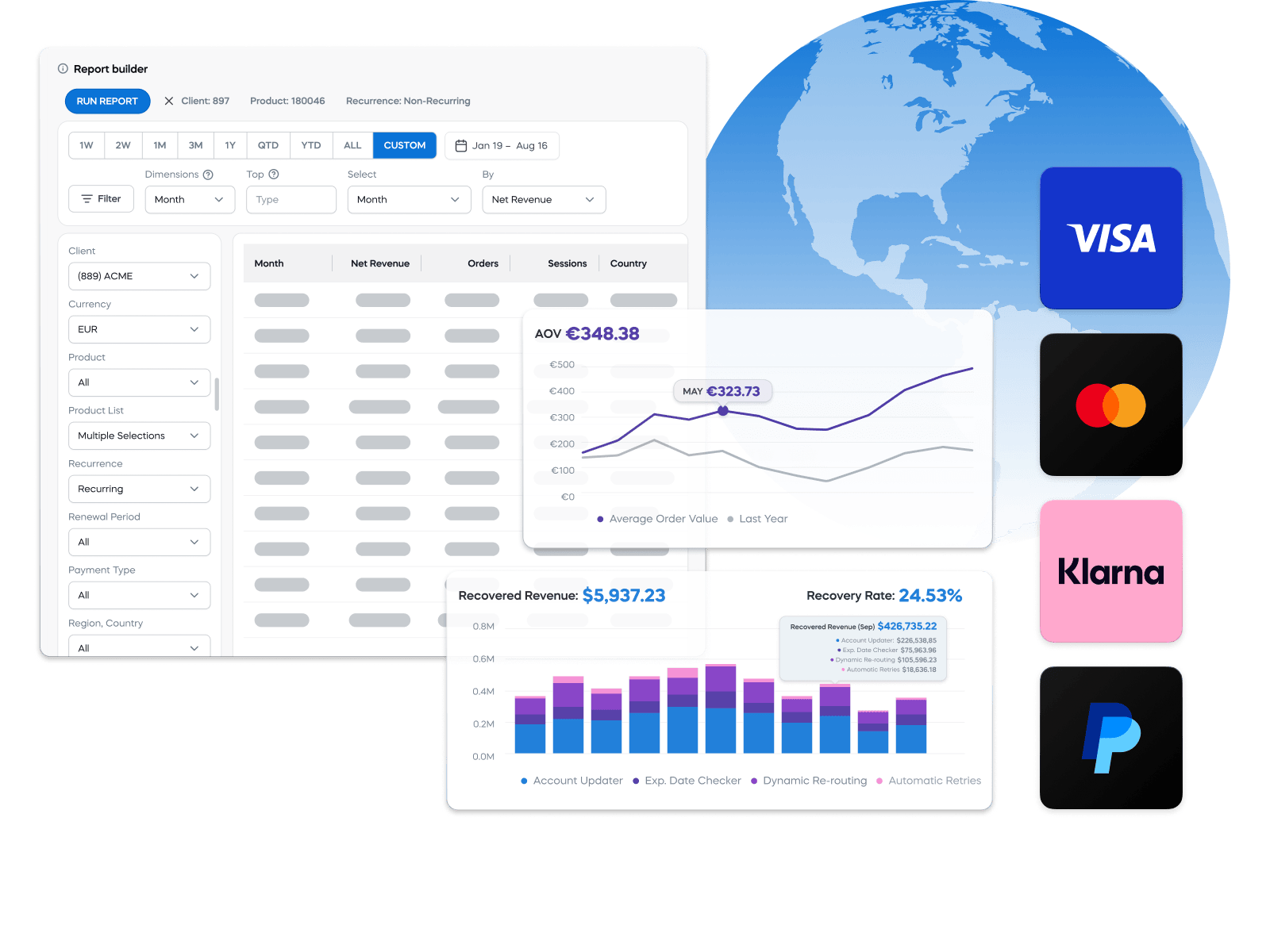

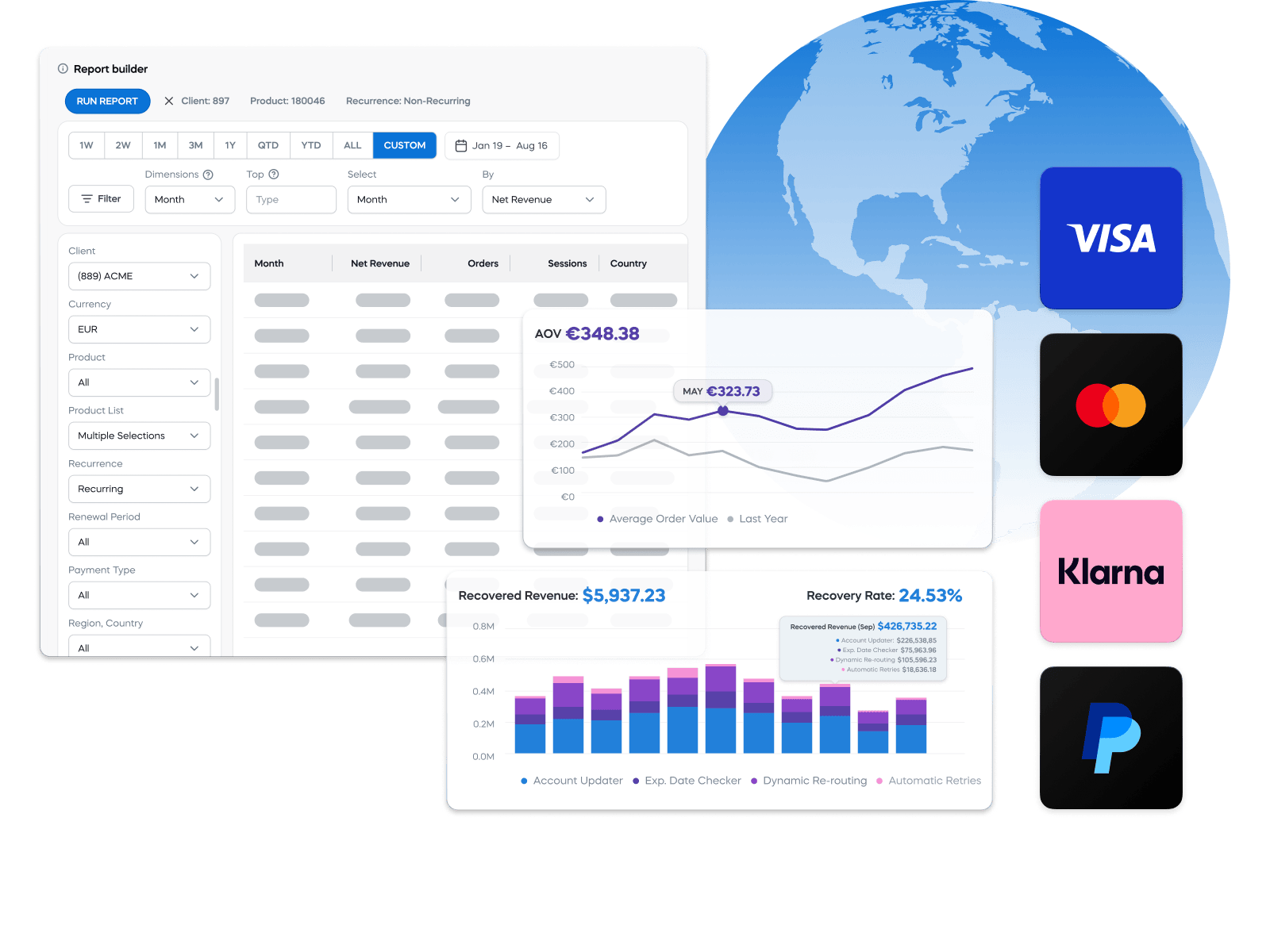

Reporting & analytics

Track pipeline performance and identify revenue opportunities across teams and channels.

- Funnel analytics from quote to renewal

- Campaign attribution and partner performance tracking

- Subscription and upsell metrics by product or region

- Forecasting and trend analysis tools

FAQs

Cleverbridge supports 33 global payment methods, including credit cards (Visa, Mastercard, American Express), digital wallets (Apple Pay, Google Pay, PayPal), bank transfers (ACH, SEPA), BNPL, and more.

Cleverbridge supports payments in 240+ countries and territories and processes transactions in 59 currencies, ensuring a seamless global experience.

We provide dynamically tailored, localized checkouts that adapt to each buyer’s language, currency, and preferred payment methods for a frictionless purchasing experience.

Cleverbridge integrates directly with your CRM, allowing sales reps to generate pre-filled checkout links that customers can use to complete purchases.

Yes. Cleverbridge supports click-to-quote and proforma invoices, allowing buyers to self-serve anytime.

Learn