- Platform

- CleverEssentials

- Global Payments

Power growth with seamless payments

Process transactions in 240+ markets with cross-border payments and built-in revenue recovery.

Powering the world’s best companies

Features

Engineered for payment performance

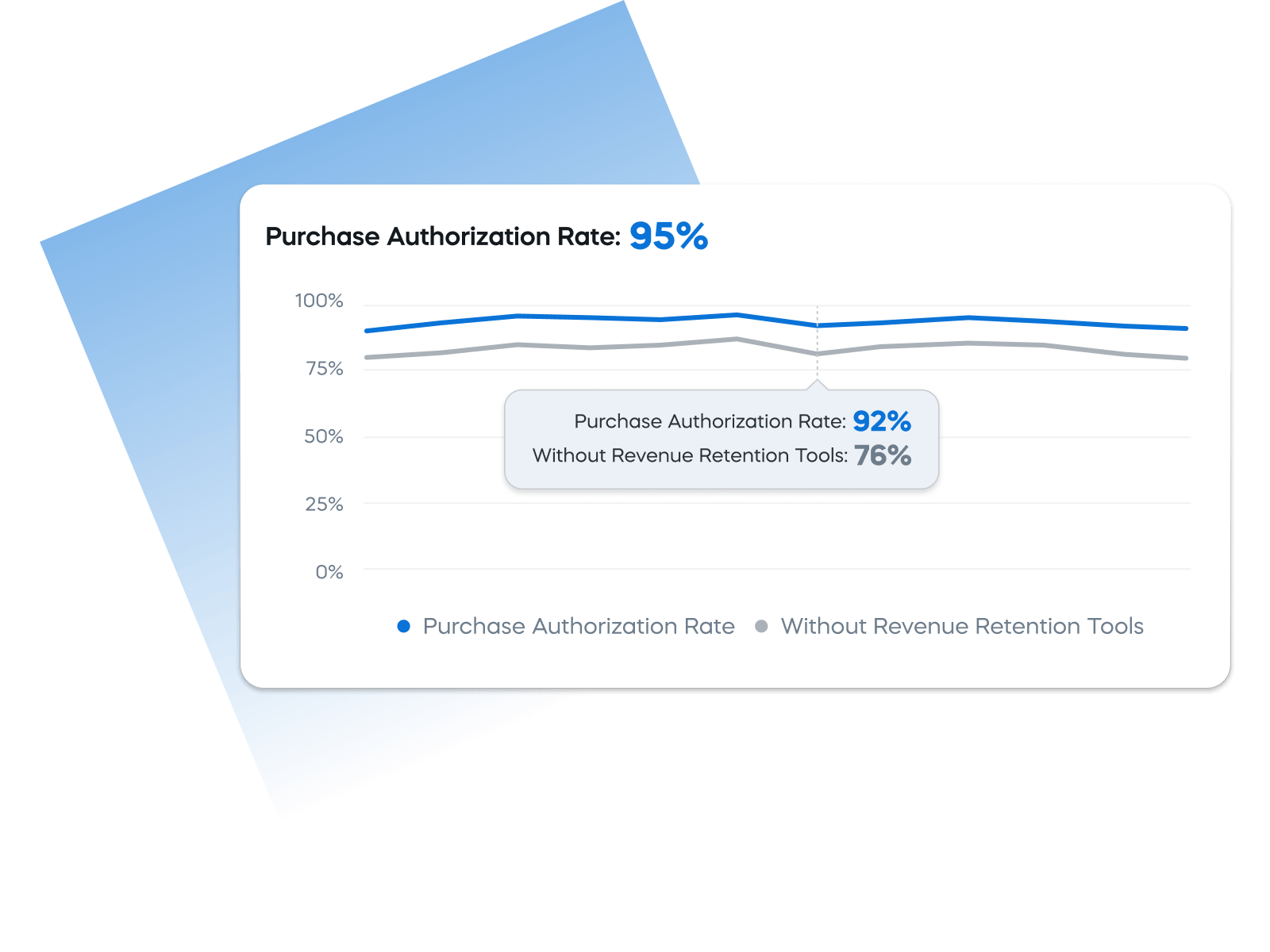

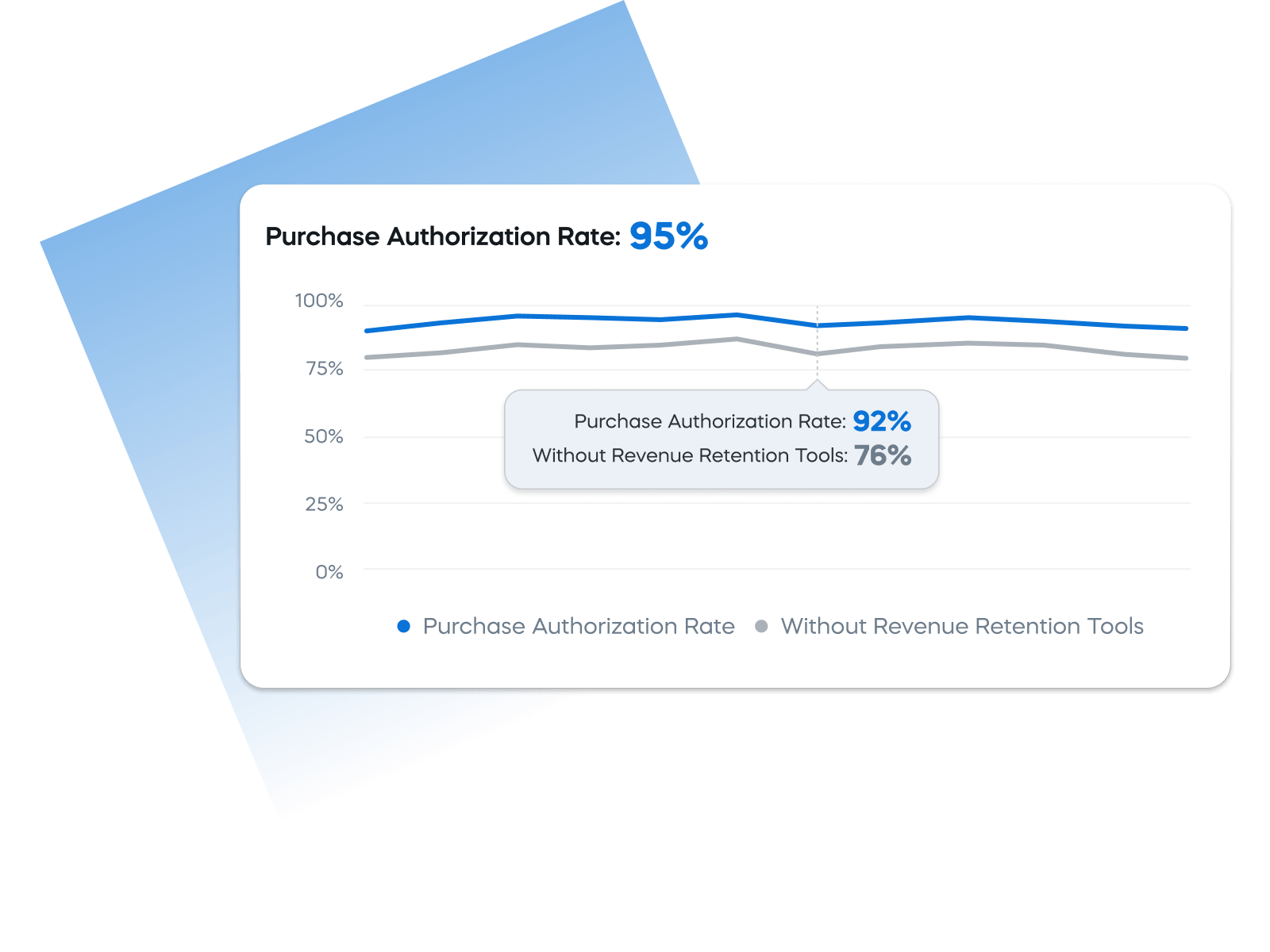

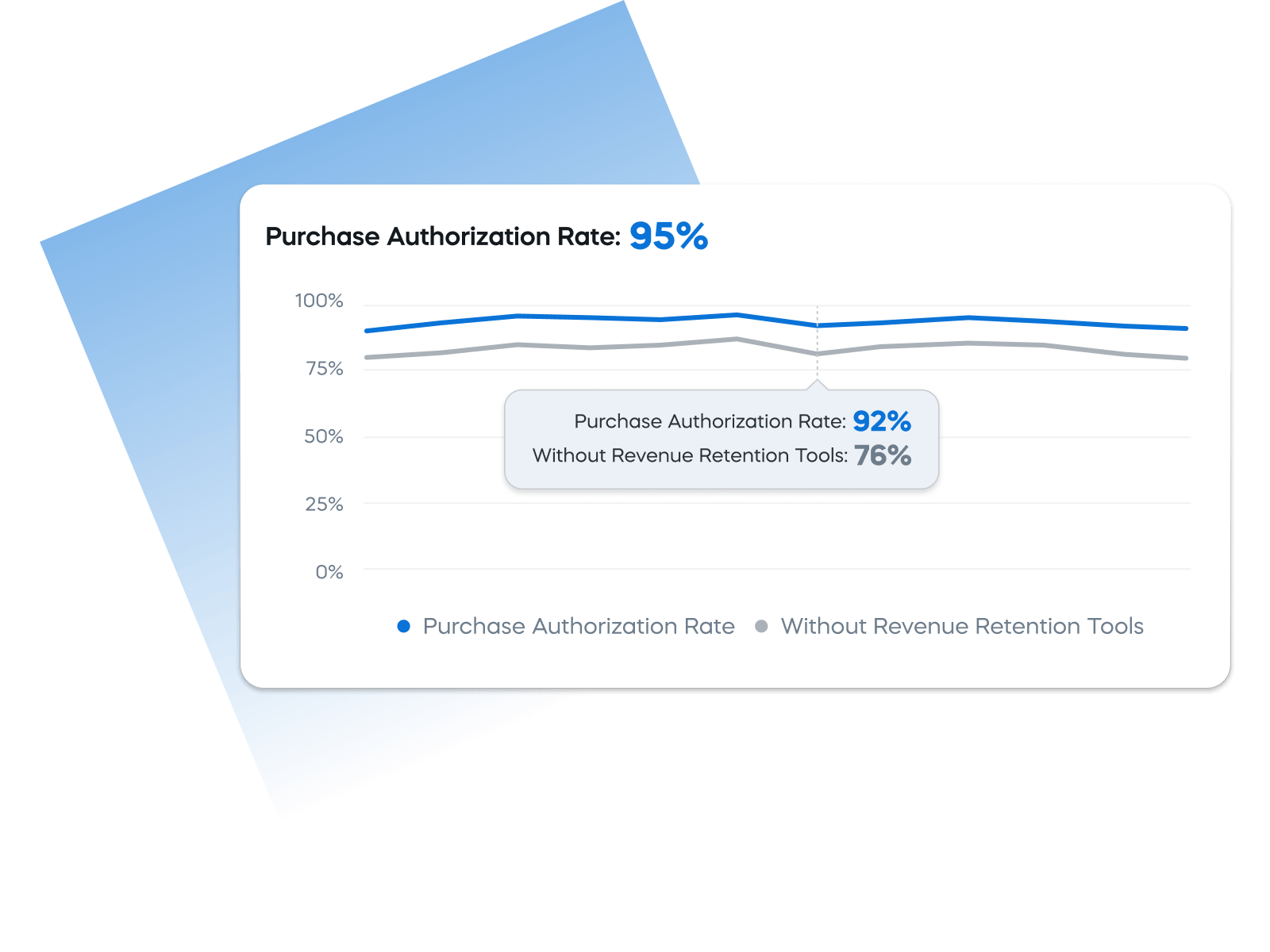

Optimized payment acceptance

Improve authorization rates and recover lost revenue with dynamic routing and smart retry logic.

- Industry-leading authorization rates with intelligent payment routing

- Dynamic retries to recover failed payments automatically

- Local acquirer connections to prevent cross-border declines

- 3D Secure and PSD2 compliance for added security

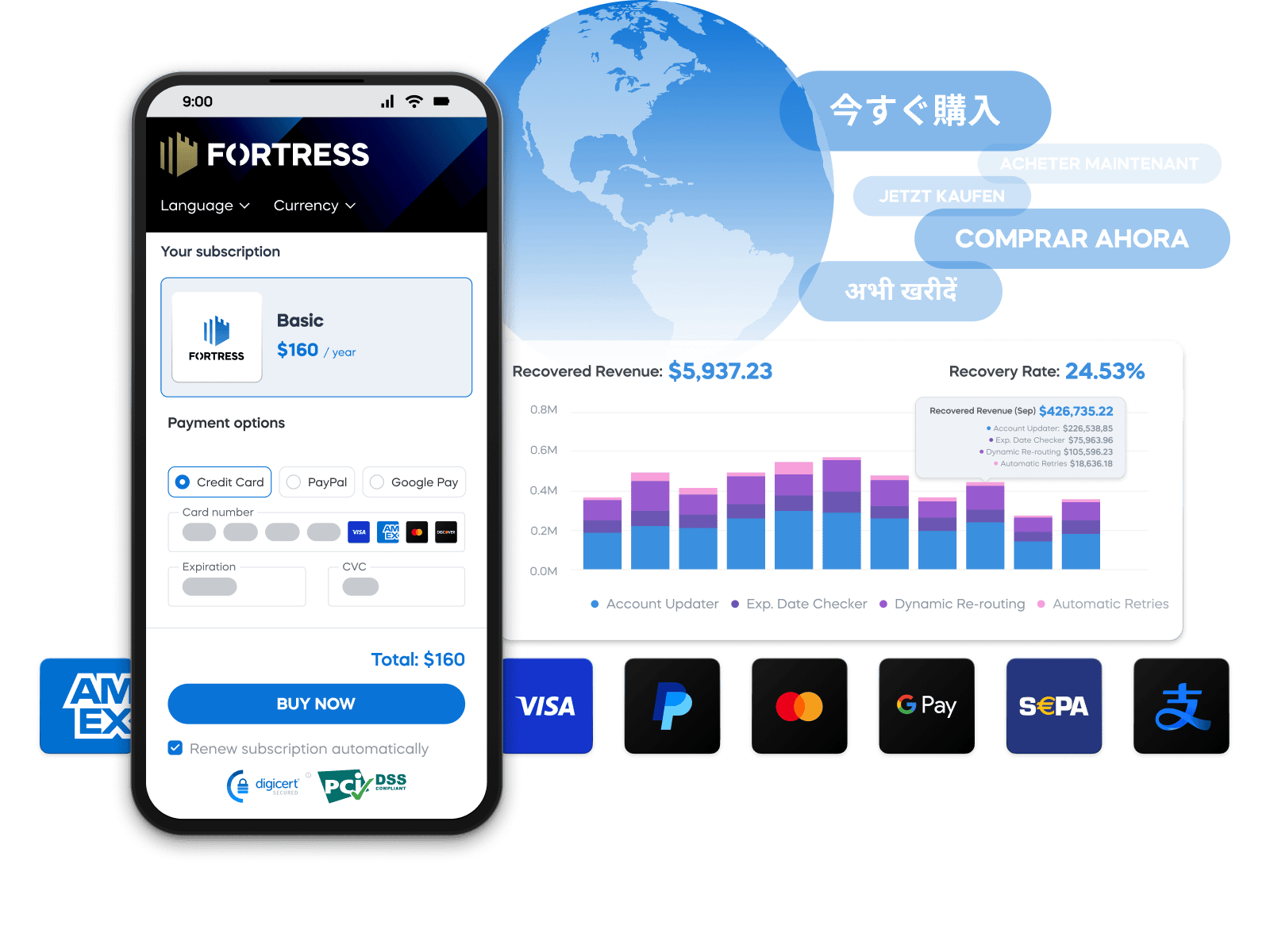

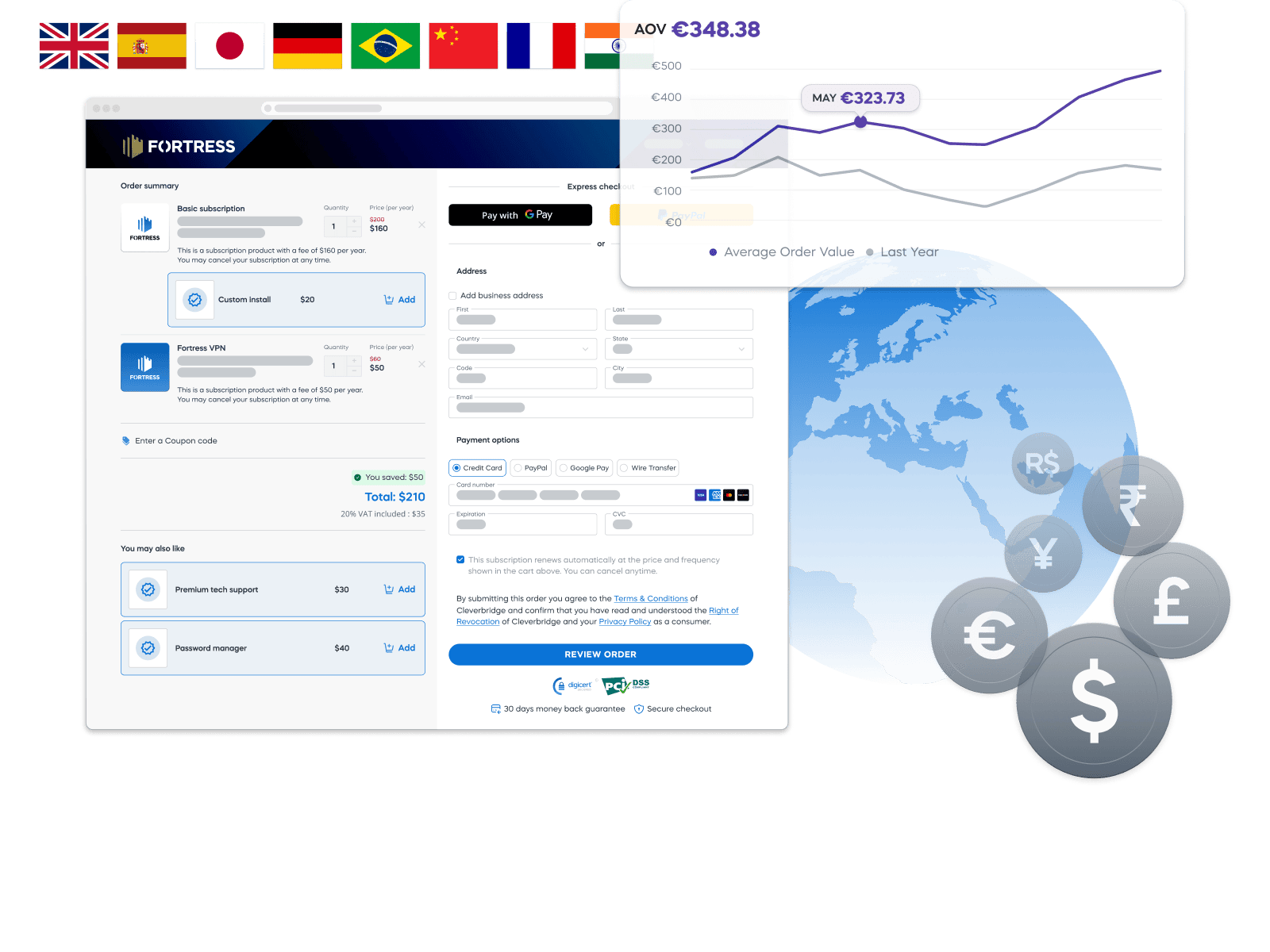

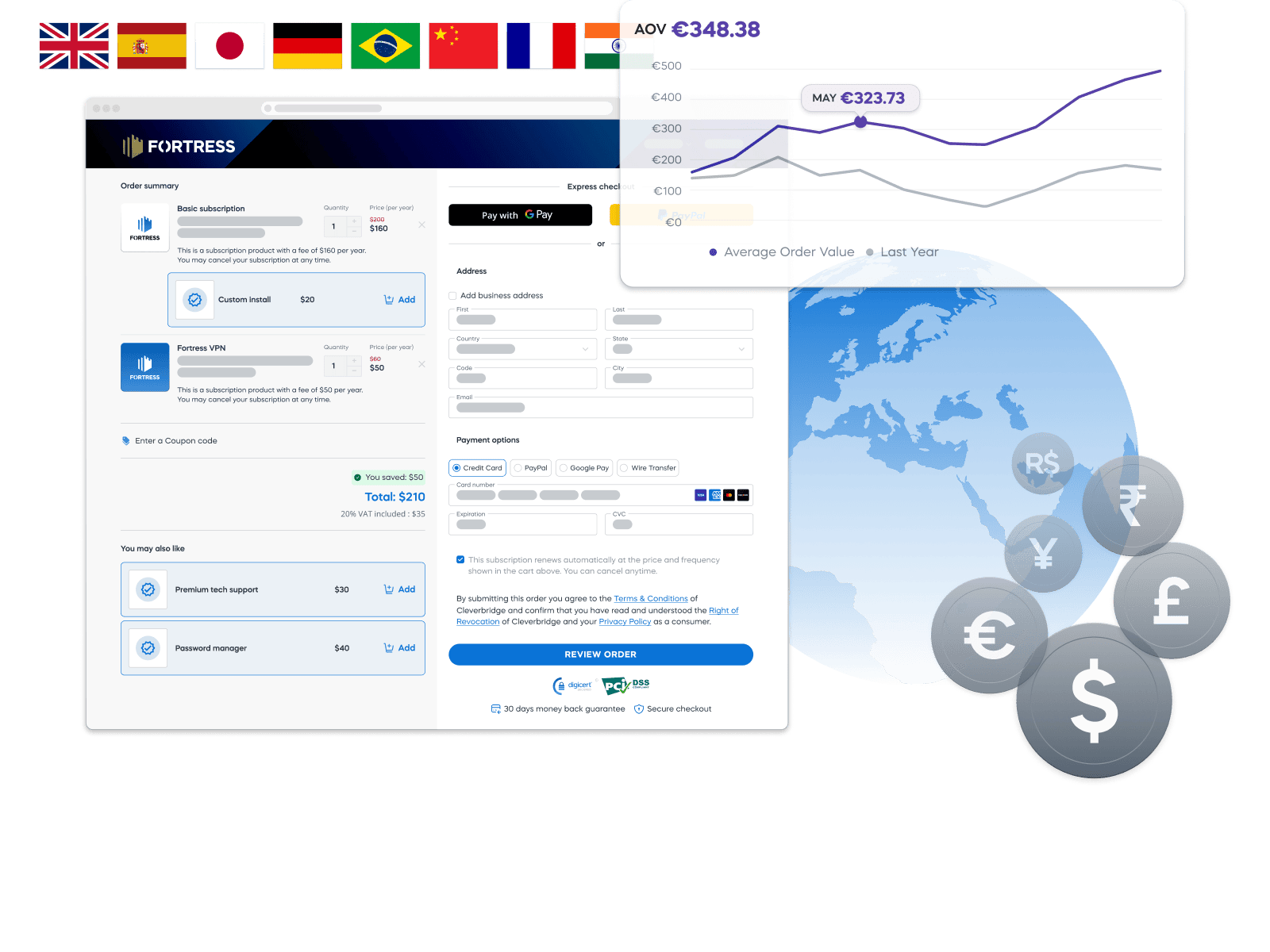

Localized purchasing experiences

Deliver familiar checkout experiences tailored to buyer location, language, and payment preferences.

- 30+ supported payment methods and 59 transaction currencies

- Checkout available in 30 languages

- Dynamic form fields optimized by region

- Local payment methods pre-selected by GeoIP

Global payment methods

Offer preferred payment methods for every region, vertical, and customer type.

- Global payment methods including credit cards, PayPal, SEPA, ACH, and BNPL

- Region-specific options like iDEAL, Alipay, and Boleto

- Secure bank transfers and digital wallets like Apple Pay and Google Pay

- Invoice and purchase order support for B2B transactions

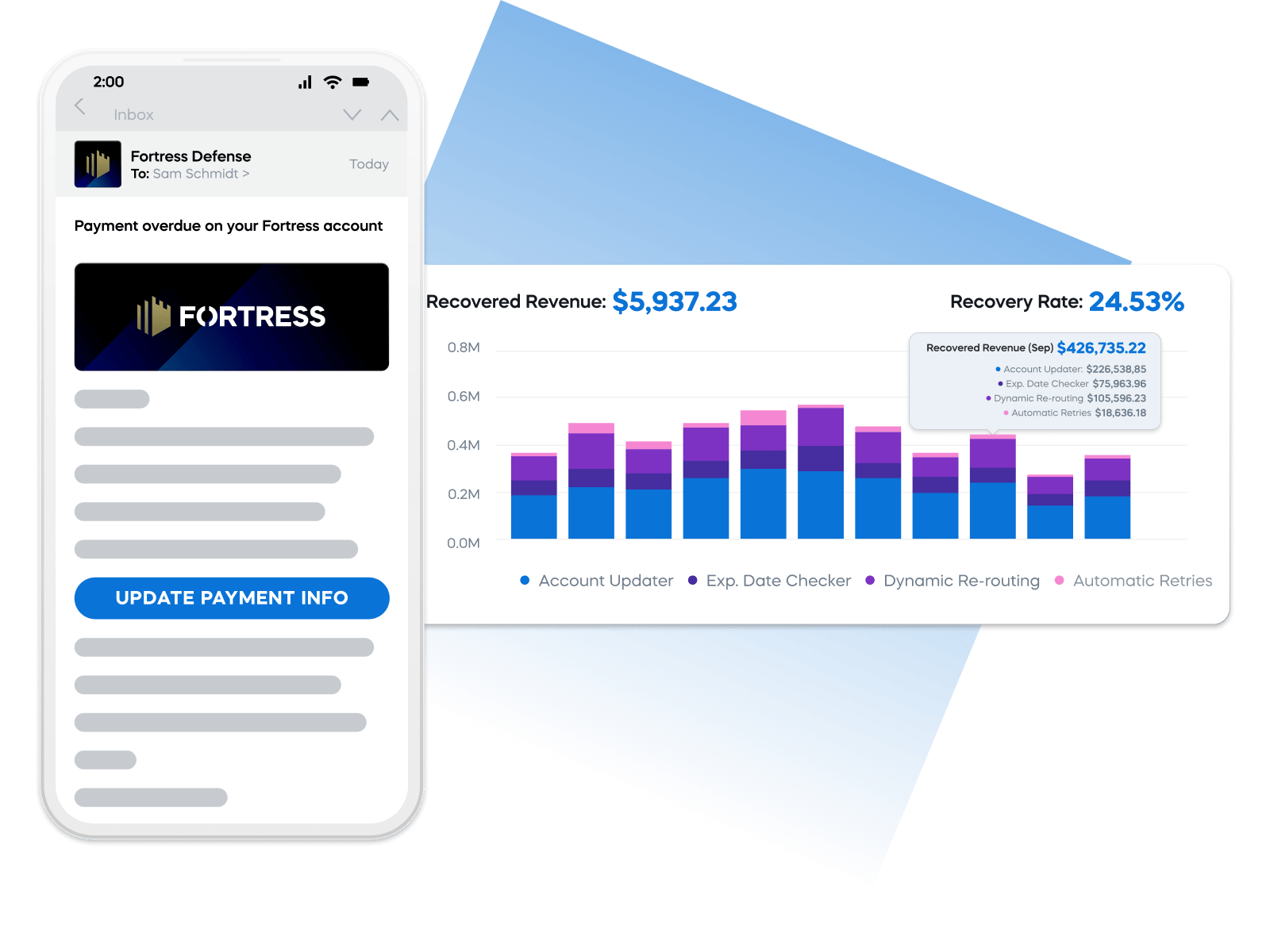

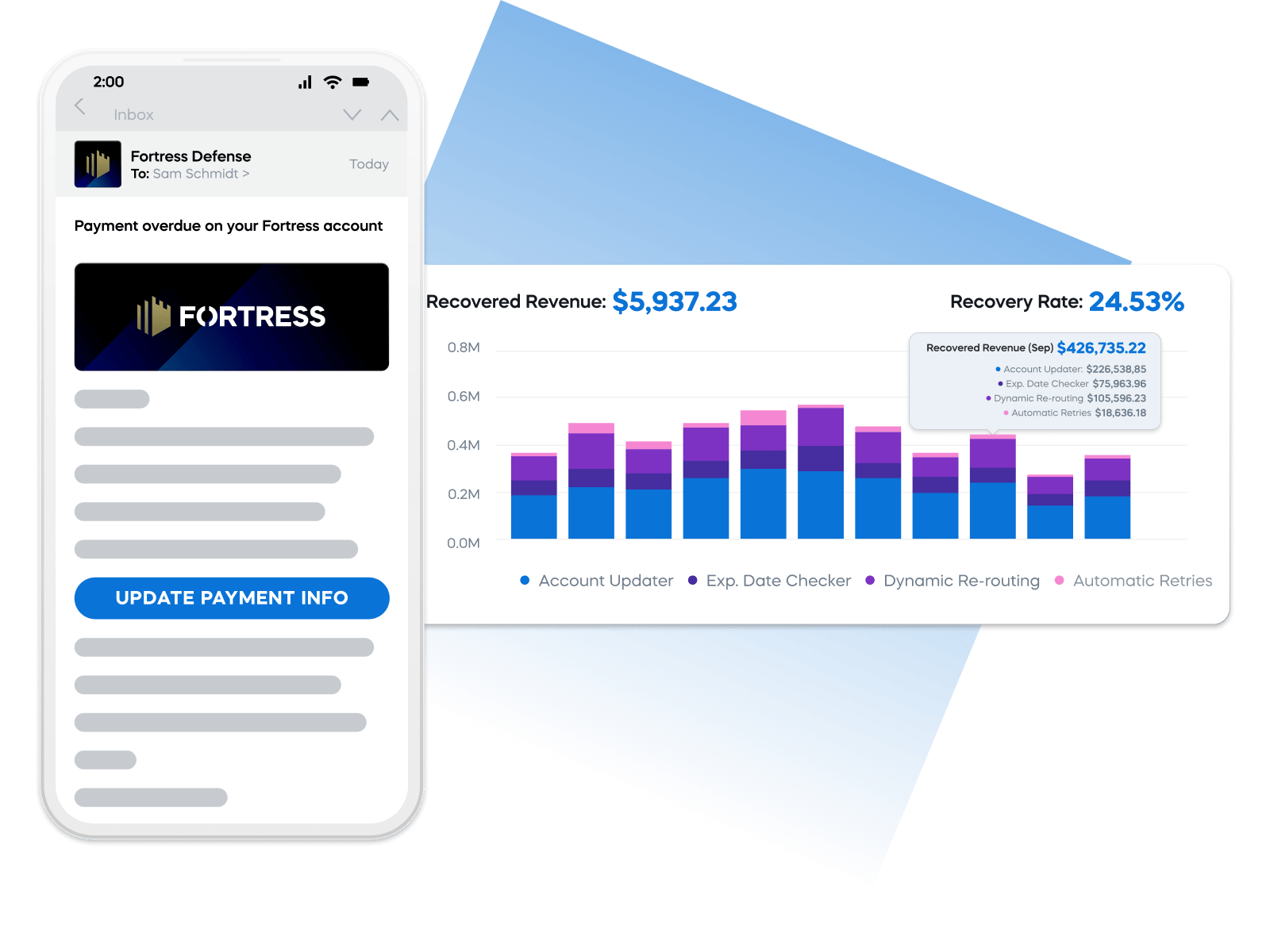

Revenue recovery tools

Recover revenue from failed payments using built-in automation and proven recovery strategies.

- Automated retries and dunning workflows for failed transactions

- Expired card detection and account updater services

- Intelligent routing to alternative acquirers for increased success rates

- Comprehensive insights into recovered revenue

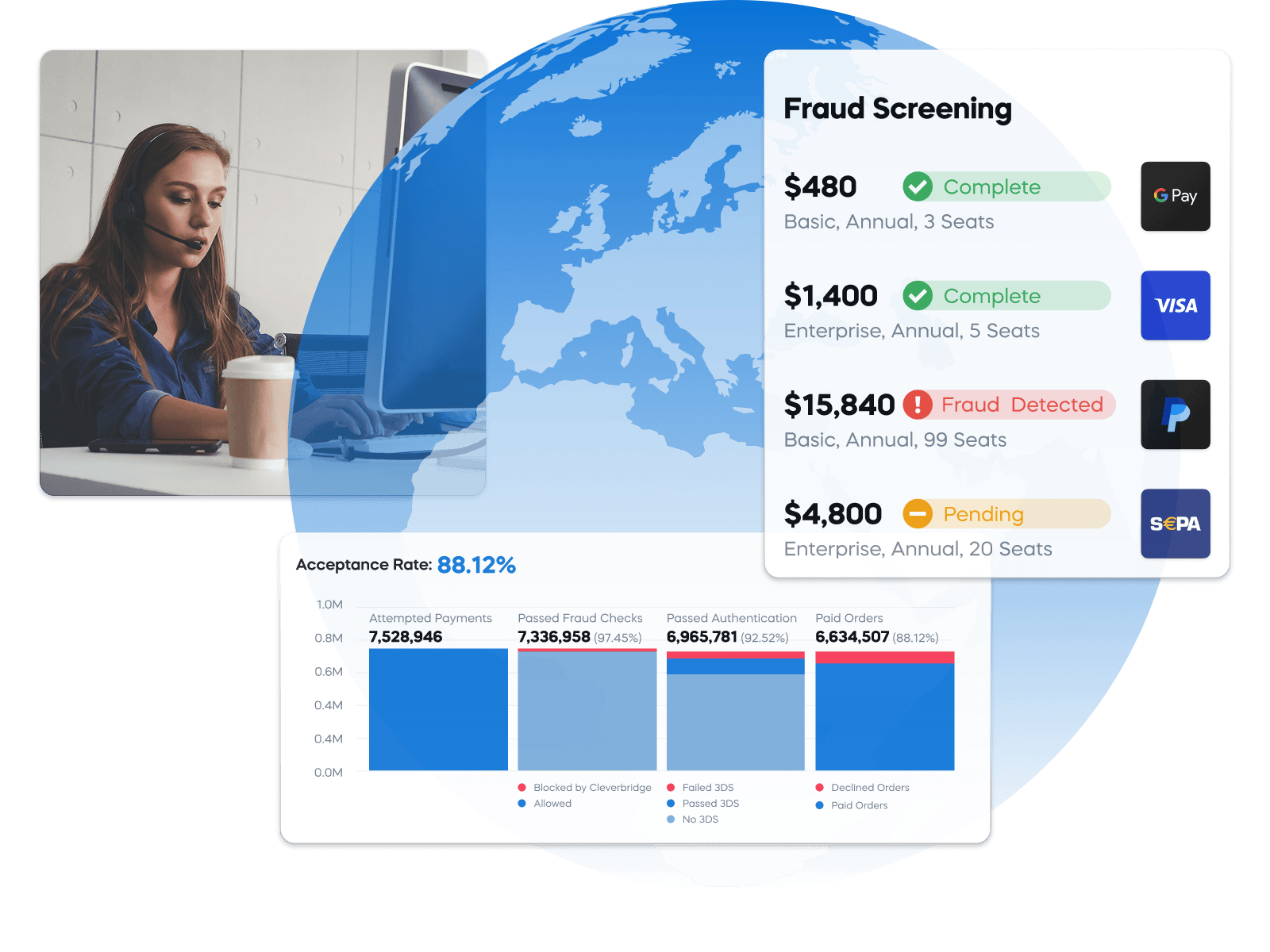

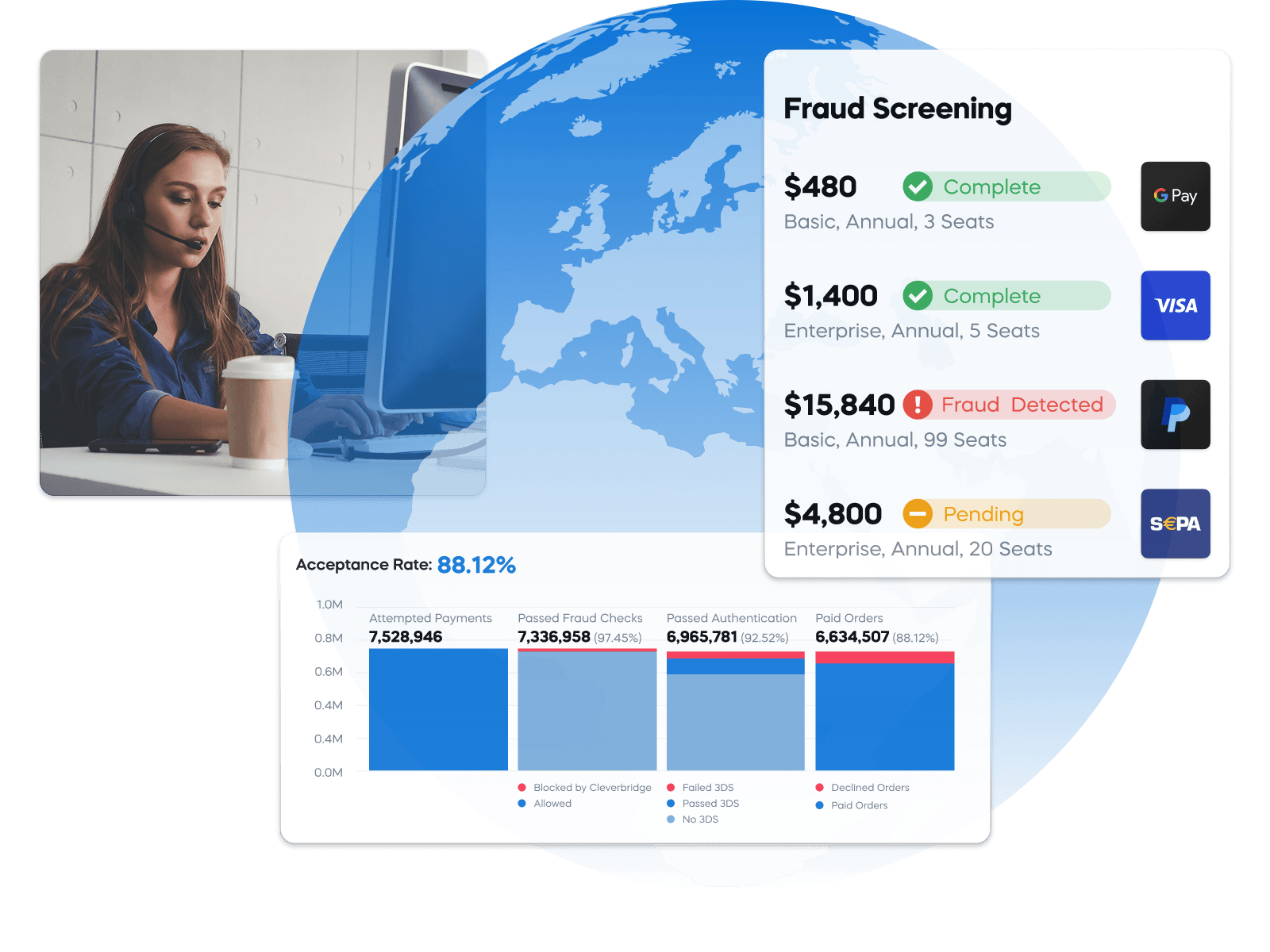

Fraud prevention & chargeback protection

Prevent fraud and reduce chargebacks without sacrificing conversion or buyer experience.

- Advanced fraud detection with real-time screening

- PCI-DSS-compliant infrastructure for secure transactions

- Automated chargeback prevention and managed dispute resolution

- Manual and rules-based approach to minimize false declines

Enterprise-grade security & compliance

Protect customer data and ensure uptime with a globally secure, compliant infrastructure.

- PCI-DSS, GDPR, and ISO 27001-compliant infrastructure

- <99.99% uptime, even during scheduled maintenance

- Multi-factor authentication and role-based access controls

- Continuous vulnerability scans and ISAE certifications

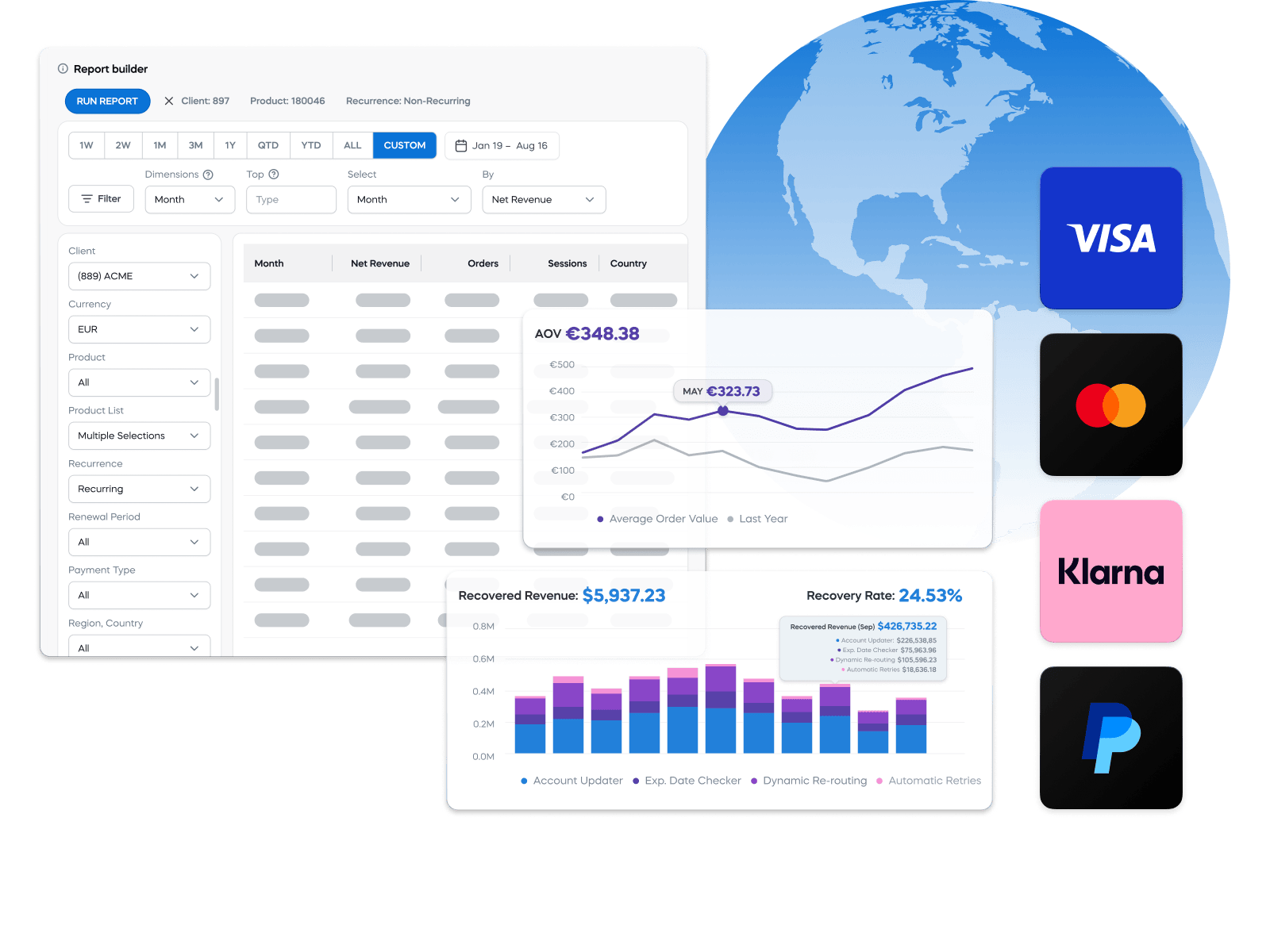

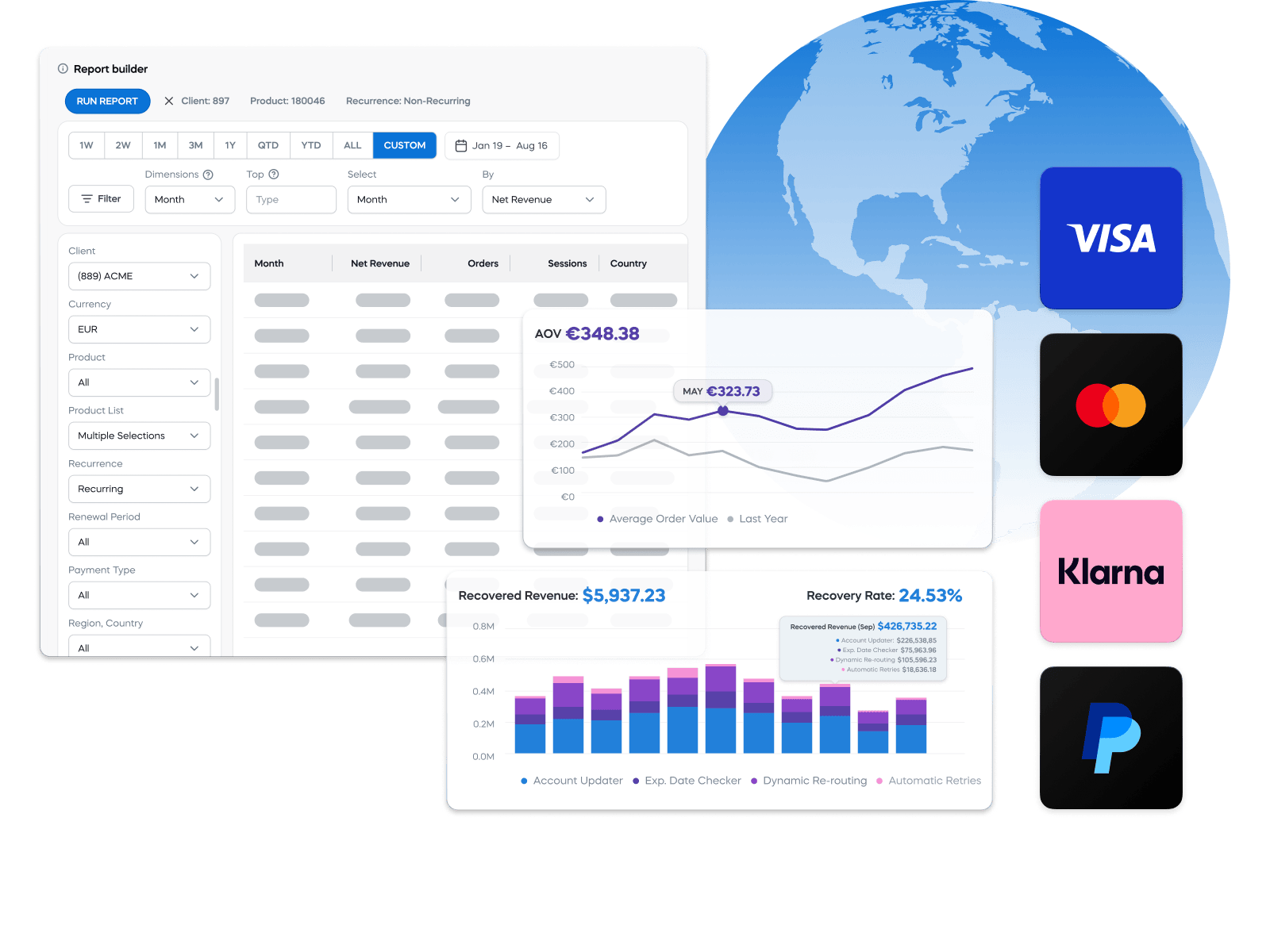

Reporting & analytics

Track performance and drive growth with actionable insights across every transaction.

- Robust dashboards for payment and subscription performance

- Analyze acceptance rates throughout the payment funnel

- Benchmarking tools to compare performance against industry peers

- Granular visibility by region, payment method, currency, and more

FAQs

Cleverbridge supports payments in 240+ countries and territories and processes transactions in 59 currencies, ensuring a seamless global experience.

We use intelligent transaction routing, retry logic, account updating, and local payment acquirers to maximize approval rates and minimize failed payments.

Cleverbridge supports 33 global payment methods, including credit cards (Visa, Mastercard, American Express), digital wallets (Apple Pay, Google Pay, PayPal), bank transfers (ACH, SEPA), BNPL, and more.

Yes, as a Merchant of Record (MoR), we manage global tax compliance, fraud prevention, and payment security for seamless, risk-free transactions.

Absolutely. Cleverbridge adheres to strict global standards including PCI-DSS, GDPR, ISO 27001, and ISAE 3402, with high-trust infrastructure and access controls.

Learn